ReInvest24 review 2023

Read this ReInvest24 review and learn more about the platform.

ReInvest24

Pros

Cons

Reinvest24 review summary:

ReInvest24 is probably the best real estate crowdfunding platform in Europe right now. The platform was made by real estate experts with experience since 2005. Utilizing their experience enables the ReInvest24 team to continuously find investment projects of high quality. This has resulted in ReInvest24 getting some of the best Trustpilot ratings and reviews in the industry. The average annual return on ReInvest24 is higher than what is offered by competitors, at a staggering 14.94%.

It’s 100% free to open an account

Introduction to our ReInvest24 review

The purpose of this ReInvest24 review is to assess whether the platform is a good choice for real estate P2P investing and how it compares to other real estate crowdfunding platforms.

In this ReInvest24 review, you can learn from our experiences with the platform before deciding if you should use it yourself.

But without revealing too much, we can already tell you that you are in for a treat with this platform.

Before you dive further into the review, we want to remind you that it only reflects our opinion about the platform. Nothing in this ReInvest24 review should be seen as financial or investment advice. We invest at our risk, and you invest at your risk. If you are in search of something specific about ReInvest24, feel free to use the table of contents below. Enjoy!

Learn about the following in our ReInvest24 review:

- What is ReInvest24?

- Main features

- What rate of return can you expect?

- Who can invest via ReInvest24?

- Is ReInvest24 safe to use?

- How we decided to invest

- Best ReInvest24 alternatives

- Conclusion of our ReInvest24 review

What is ReInvest24?

ReInvest24 is a real estate investment platform.

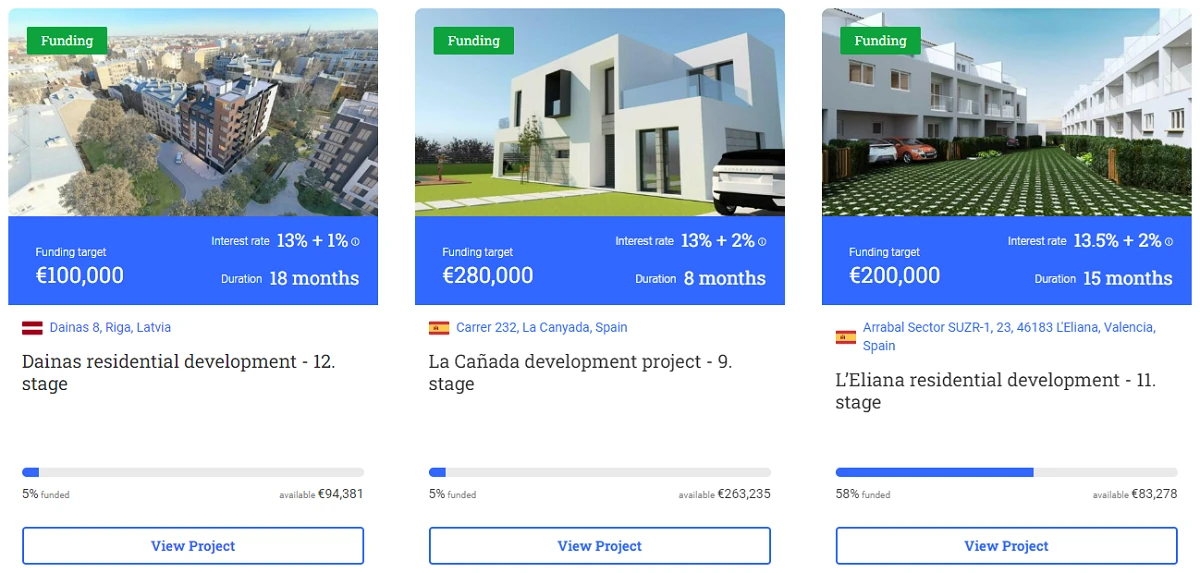

The platform offers investment options in development projects, real estate loans, rental projects, and business loans from Estonia, Latvia, Moldova, Spain, and Germany. The projects have a duration ranging from 1 to 36 months.

The company, ReInvest24 OÜ was founded in 2017 by Tanel Orro – a former employee in asset management at LHV. The platform launched in 2018.

Since its launch, ReInvest24 has grown to become one of the most popular real estate crowdfunding platforms in Europe.

The team behind the platform has hands-on experience in the real estate industry going back to 2005. This enables them to identify some great deals for investors.

The platform itself makes it incredibly easy to invest in real estate oriented projects.

On the platform, you will find several types of investment opportunities:

Investments on the platform have a minimum requirement of €100. This is a bit higher than on other platforms.

ReInvest24 statistics:

| Launched: | 2018 |

| Investors: | 27,100 + |

| Interest rate: | 13 – 17 % |

| Loan period: | 6 – 36 months |

| Loan type: | Real estate |

| Loans funded: | € 40,442,160 + |

| Min. investment: | € 100 |

| Max. investment: | Unlimited |

ReInvest24 FAQ:

ReInvest24 Trustpilot reviews:

ReInvest24 is one of the best-rated real estate crowdfunding platforms on Trustpilot. Currently, the platform is rated at 4.5/5 stars on Trustpilot.

Compared to some of the best Peer-to-Peer lending sites, ReInvest24’s rating on Trustpilot is very high.

Most of the investors are happy with the business model, where the ReInvest24 team only focuses on a few projects but makes a lot of due diligence on each. ReInvest24 is also endorsed by investors for having great communication, transparency, and UI. A lot of investors state that ReInvest24 is their favorite real estate crowdfunding platform.

With over 100 great reviews, the platform is worth considering.

Main features

In the following part of our ReInvest24 review, we will explain some of the main features of the platform, and why they are great for you as an investor.

1. Sell shares on the ReInvest24 secondary market

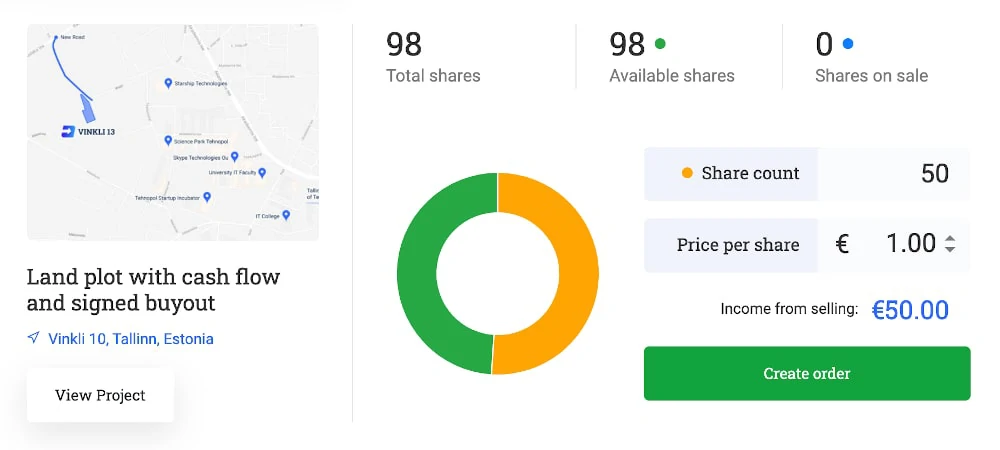

In late 2020, ReInvest24 introduced a secondary market to its platform.

This made it possible for investors to sell shares before they initially were planning to if they want to withdraw some cash from the platform.

To access the sell option on the platform, simply go to “My Investments”, and click “Sell” on the investment you would like to sell.

You will then be met with the following screen:

At the time being, the fee for selling on the secondary market is 0%. Buyers will still have to pay the normal 1% fee like on the primary market.

2. Project live stream cameras

If you invest in projects in Moldova, you can see the development of the projects from a live stream.

To access the live stream, simply go to the “Insider Updates” of the project.

This feature is great as it gives a sense of security that you are actually able to verify that things are moving forward.

What rate of return can you expect?

The average annual return on ReInvest24 is 14.94%.

Your return can both be higher or lower depending on the projects you choose to invest in.

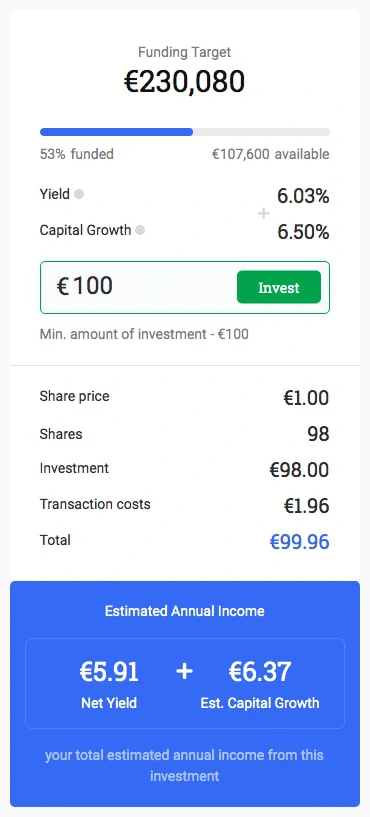

On ReInvest24, it is very easy to find out what your return will be for a specific project.

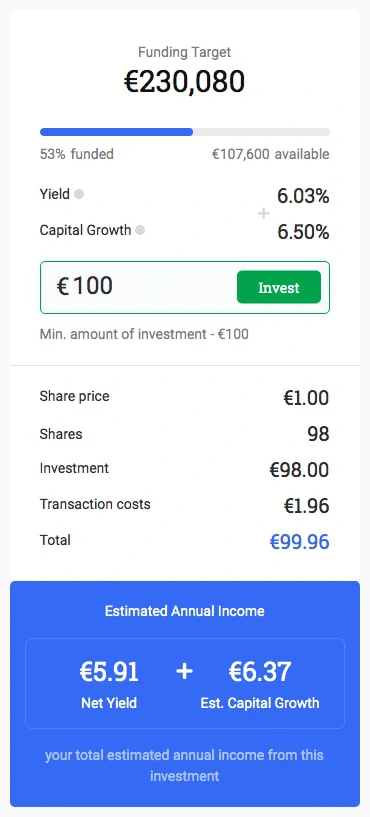

When you have found a project you like, you can select it and enter the amount of Euro you want to invest.

Then you can quickly see an estimate of how much you want to earn from the given investment:

ReInvest24 could make it clearer how much your estimated income would be.

If you are not too good at math, it should not be necessary to find a calculator to add the numbers together.

The return on ReInvest24 is very high compared to other platforms like Profitus, Rendity, and HeavyFinance.

Who can invest via ReInvest24?

It is stated in ReInvest24’s FAQ that everybody can invest on their platform if they are older than 18 years old, and their active legal capacity is not restricted.

Furthermore, KYC verification is also mandatory to start investing via the platform.

Getting KYC verified is as easy as sending a picture of your passport. From there you should be verified within 24 hours.

If you comply with these requirements, you can easily become a ReInvest24 investor. Simply follow this process:

- Create an account

- Verify your identity with a passport or ID-card

- Transfer money to your account

- Invest your money

As you can see, it is really easy to get started using ReInvest24.

If you want to become a ReInvest24 investor, simply press the button below to set up an account. It’s probably the quickest way to go from reading this ReInvest24 review to actually investing yourself:

Is ReInvest24 safe to use?

The security of a platform is always one of the most important factors for investors.

As in our other reviews, we have also taken a look at the security of the platform in this ReInvest24 review.

We believe that enough has been done to secure you as an investor.

If you’re considering investing through ReInvest24, we strongly recommend spending a few minutes watching this video:

The video explains the structure of the company, how the investments are secured, how property shares work, and much more.

We couldn’t have explained it ourselves better, which is why we added ReInvest24’s video.

Throughout the COVID period, the platform was one of the most reliable P2P platforms, with no major issues or malfunctions.

How we decided to invest

We decided to test the platform with a minimum investment of €100.

We picked the project that, at the time, promised the highest return on investment.

The project we ended up buying was this land plot with cash flow and a signed buyout:

The return on shares of this investment project is estimated at 12.28% return annually. We will, of course, let you know as the investment develops.

The information provided about the project was thorough, and buying shares in it was easy.

As you can see in the image below, there is also high transparency in what you pay for upon investing in a project:

Due to transaction costs, we ended up with 98 shares of the land plot with cash flow and a signed buyout.

Best ReInvest24 alternatives

Are you unsure if ReInvest24 is the right platform for you, after reading this ReInvest24 review?

There are hundreds of P2P platforms out there, which can make it hard to determine if you have found the best platform or if you should look for other ReInvest24 alternatives.

The main categories for P2P platforms are consumer loans, real estate, and business loans.

Here are the best ReInvest24 alternatives right now:

There are many reasons why you should consider a ReInvest24 alternative.

First and foremost, you might not find that ReInvest24 suits your investment needs. When it comes to P2P lending platforms, every P2P investor has different needs. It’s therefore crucial that you understand your main investment criteria and find a platform that matches.

It can also be a good idea to consider ReInvest24 alternatives to simply diversify your investments across more than one platform and reduce your overall platform risk. This can also be done with different types of platforms like the ones you can see above.

Conclusion of our ReInvest24 review

ReInvest24 is probably the best real estate investment platform right now.

The investments on the platform are found by real estate professionals with experience going back to 2005.

All investments are secured by a mortgage and go through a due diligence process before landing on the platform.

Contrary to P2P platforms like Mintos, ReInvest24 is not aiming to provide as many investment opportunities as possible. Instead, they are focusing on adding high-quality projects to the platform. This means that you will find limited diversification options on ReInvest24.

If you seek broader diversification, you can use the platform in combination with ReInvest24 alternatives such as EstateGuru, Max Crowdfund, and Bulkestate.

ReInvest24 offers stable returns at around 14.94%. This is a very high return compared to other platforms.

ReInvest24 has some of the best investor ratings and reviews on Trustpilot. The platform is rated 4.5/5 stars right now.

Would you like to invest in the platform after reading our ReInvest24 review? Then click the button below to sign up: