Debitum review 2023

Read our Debitum review, and decide if the platform is for you.

Debitum

Pros

Cons

Debitum review summary:

Debitum is one of the best P2P lending companies for small business financing. The platform is very popular among its investors, and it is one of the best-rated P2P lending companies on Trustpilot. Investors interested in lending money to businesses are highly recommended to take a closer look at Debitum, as it is one of the leading platforms in business financing right now.

It’s 100% free to open an account

Introduction to our Debitum review

Since Debitum is only from 2018, search engines are yet to be flooded with reviews and experiences from users. So due to encouragement from multiple parties, we decided to bring you one of the first in-depth Debitum reviews.

In this Debitum review, we will take a look at how the platform manages to separate itself from its competitors. Of course, we have also made our best assessment of safety on the platform. Last but not least, we will give you insight into how we chose to invest, and what our opinion about the platform is.

Before you really dive into this Debitum review, we will remind you that it only reflects our opinion on the platform. Therefore, nothing you read on this page should be considered investment advice.

If there is something specific you want to know more about, feel free to use the navigation below. Enjoy!

Learn about the following in our Debitum review:

- What is Debitum?

- Main features

- What rate of return can you expect?

- Who can invest via Debitum?

- Is Debitum safe to use?

- How we decided to invest

- Best Debitum alternatives

- Conclusion of our Debitum review

What is Debitum?

Debitum is a P2B platform specializing in small business financing. On the platform, you will be able to invest in pools of asset-backed business loans:

The platform differs a lot from other platforms by aiming to become very decentralized. As of now the rating of the various loans is, for example, made independently of the Debitum. The same is true in a number of other areas.

Based in Latvia, Debitum was funded in 2018 via an ICO. Since then, the platform has just continued to grow.

Compared to a lot of other P2P lending sites, Debitum has a relatively small group of investors connected to its platform. At the time of writing, there are just over 10,400 investors investing via Debitum.

Debitum statistics:

| Launched: | 2018 |

| Investors: | 10,400 + |

| Interest rate: | 9 – 12 % |

| Loan period: | 3 – 48 months |

| Loan type: | Business |

| Loans funded: | € 71,500,000 + |

| Min. investment: | € 10 |

| Max. investment: | Unlimited |

Debitum Network ICO:

An interesting fact about Debitum is the fact that it was funded with an ICO (Initial Coin Offering) in 2018. This basically meant that Debitum issued its own coin (also known as a token) called Debitum Network.

While you are currently able to find the Debitum Network token on the platform, the company is still in the phase of thinking about how to utilize the blockchain area further on its platform. You should therefore not expect the platform to be very blockchain-focused as of now.

You can see the current price of the Debitum Network token on CoinMarketCap.

Debitum FAQ:

Debitum Trustpilot reviews:

Investors have rated Debitum on Trustpilot. At the time of writing, nearly all reviews are 5 stars. This has resulted in an impressive rating of 4.4 stars.

With an excellent Trustpilot score, Debitum is definitely worth considering as a business P2P platform.

Main features

Now that it’s established that Debitum is actually a quite popular platform among its investors, let’s take a look at some of the main features on the platform:

1. Debitum buyback guarantee

Most loans on the platform are secured with the Debitum buyback guarantee.

This means that if the repayment of a loan is late for more than an agreed number of days (usually 90 days), then the loan originator is obligated to buy back the loan and cover the remaining principal as well as outstanding interest.

2. Tax report

Another great feature of Debitum is its automated tax calculation and the provision of necessary documents for tax reporting. This is a crucial point of convenience and accuracy that cannot be understated.

By automatically calculating and withholding income tax, Debitum spares its users from the complexity and time-consuming task of figuring out their tax requirements on the earnings they make through the platform. This eradicates the potential for errors in tax calculations that could lead to issues with local tax authorities. It provides peace of mind for investors, as they can be confident that the necessary tax-related procedures are correctly handled.

To get the tax report, simply log in to your account and click “My balance” in the top menu. Here you can easily generate an account statement for a selected period.

3. Multilingual support

One key feature that makes Debitum stand out is its multilingual support. The P2B lending platform is translated into English, German, Russian, Latvian, Spanish, and French.

For an international platform such as Debitum, this multilingual support is incredibly important and beneficial for users. It enables the platform to reach a broader market of users and aids in breaking down language barriers that could deter potential users.

The translation into these six major languages means that it can cater to a wider range of countries, that may have different dominant languages. Furthermore, it allows users to more confidently and correctly utilize the platform in their native language, resulting in a seamless and more effective user experience.

4. Refer-a-friend program

When you register on the platform, you can earn a bonus for referring your friends to Debitum. You can do this by using your Debitum referral code. This code can be found when you log in to your account.

Here you can just click “invite friends” to earn a bonus for each friend that signs up using your referral code and invest at least €1,000 in the first 30 days from registration.

The Debitum refer-a-friend program provides financial incentives to individuals for referring new investors to their platform. This is how it works:

- If a referred friend makes an investment of anywhere from 1000 to 4999 EUR, both the friend who did the referral and the newly referred friend are rewarded with a bonus of 25 EUR each.

- If a referred friend invests 5000 EUR or more, both persons involved receive a bonus of 1.0% of the total investment made.

For instance, if your referred friend invests €10,000, both you and the friend would get €100 each (1% of €10,000).

However, within this incentive program, the maximum bonus any party can receive from a single referral is capped at €1000.

5. Get a +1% Debitum cashback bonus

New users on Debitum can get a 1% cashback when they invest in asset-backed securities with a term of at least 90 days. To get the bonus you must invest within 60 days of signing up. All you need to do is click “Activate bonus” below.

This way you don’t have to rely on the refer-a-friend program if you don’t know anyone using the platform.

What rate of return can you expect?

The return you can get on Debitum depends on how you choose to invest your money. Currently, Debitum has an average return of 12.50%. Since this is the average return, you can reasonably expect a similar return.

It is our experience that it is quite easy to achieve such a return by either picking investments manually or even by using their auto-invest function.

The return on Debitum is lower than what you can find on popular high-yield P2P platforms like Lendermarket, Bondster, and Esketit.

Who can invest via Debitum?

To be able to invest via Debitum’s platform, it is a requirement that you are at least 18 years old. At the same time, it is a requirement that you have a full and unrestricted legal capacity and that you are able to meet monetary obligations. Of course, one must not be declared insolvent.

In addition, you have to undertake a KYC process and activate your account with two-factor authentication before being able to use your account properly.

Do you meet the above requirements? Then there is a good chance for you to become an investor at Debitum. Just follow this process:

- Create an account

- Complete the KYC process

- Add two-factor authentication

- Add funds to your account

- Start investing

In case you are unsure whether you can invest with Debitum or not, you can always contact their support via phone or e-mail. Please find the contact information at the bottom of this page.

Are you ready to go from reading this Debitum review to investing yourself? Then press the button below. By doing so, you will be taken to a page where it is quick to set up an account and start investing:

Is Debitum safe to use?

One of the key things we want to address in this Debitum review is the safety of the platform. So let’s get into what the platform has to offer:

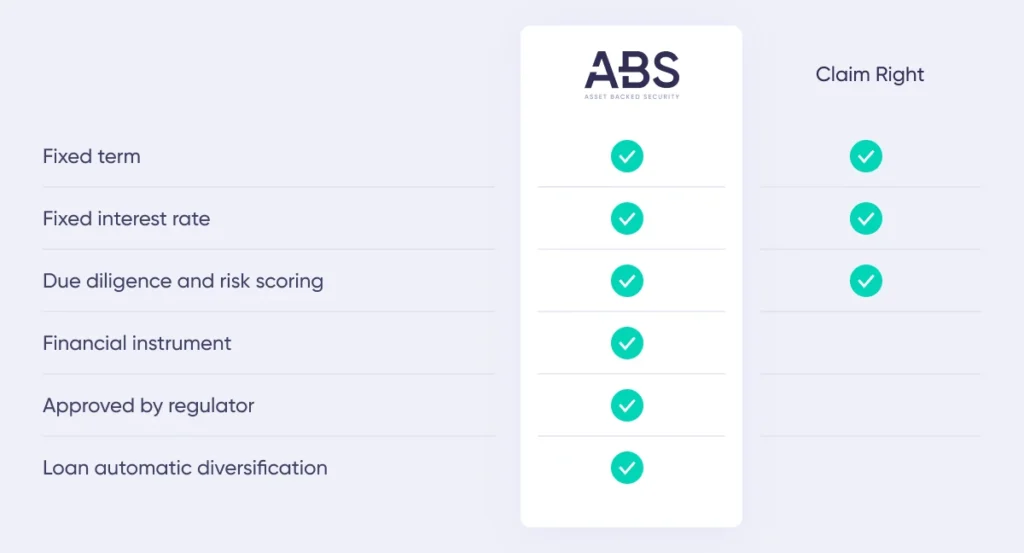

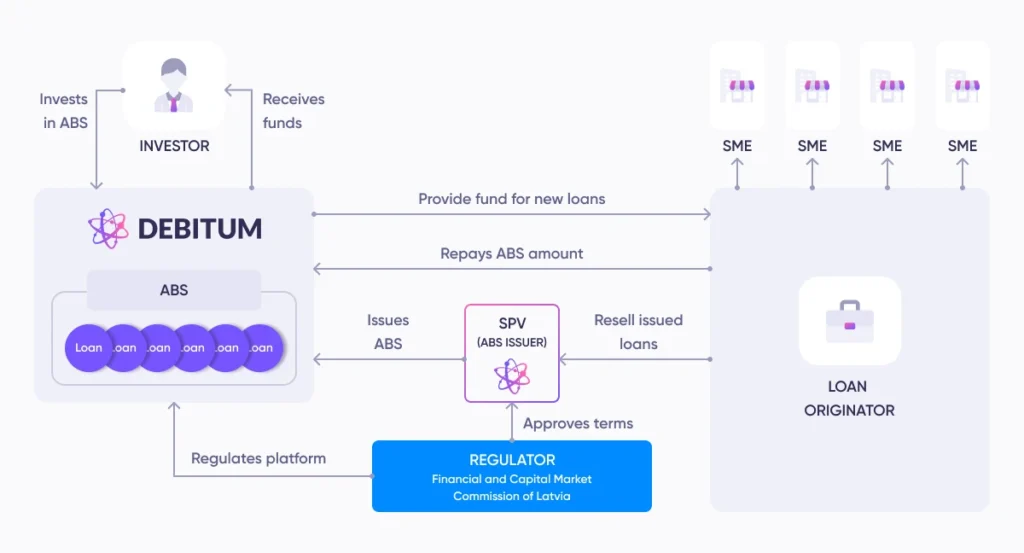

Regulated platform with Asset-Backed Securities (ABS)

Debitum is licensed and regulated by the Financial and Capital Market Commission in Latvia since September 2021.

In order to meet regulations, Debitum changed the way you invest in loans on its platform. Where you were previously investing in claim rights on the platform, you are now investing in financial instruments called Asset-Backed Securities (ABS).

Asset-backed securities are basically derived from a pool of underlying assets (loans). This is illustrated in the following:

The most profound change of risk by implementing this is that you are no longer investing only in one loan at a time but in multiple different loans.

Use of independent firms

First of all, it is relevant to mention that Debitum has the desire to be very decentralized. They achieve this by using independent service providers for risk assessment, insurance, debt collection, and more.

The use of independent companies makes the credit scores more credible, as they are less likely to be biased.

Platform safety

Another place where safety measures have been made is on the Debitum P2P platform itself. Here it is very clear that safety is paramount.

For example, you will quickly find that you are automatically logged out when you are not active on the site. At the same time, there is a requirement that you have two-factor authentication enabled and live up to KYC requirements before you can use certain functions.

If you do not meet some of the specific requirements, you cannot, for example, withdraw funds from the platform.

How we decided to invest

With €500 on our account, we decided to put the platform to the test in order to learn about user-friendliness, transparency, and more.

With help from auto-invest, we chose to invest in loans with a credit score from A+ to C. This gives a probability of default on the loans over the next 12 months of roughly 0.00%-2.42%.

As you set up an auto-invest strategy, please be aware that some of the loan credit scores lead to a very high probability of default. Before you invest we recommend that you read more about credit scoring on the platform.

Already after a few months, we had a good insight into the return on Debitum. The following are our investment results after just a few months of using the platform:

Best Debitum alternatives

Are you unsure if Debitum is the right platform for you, after reading this Debitum review?

There are hundreds of P2P platforms out there, which can make it hard to determine if you have found the best platform or if you should look for other Debitum alternatives.

The main categories for P2P platforms are consumer loans, real estate, and business loans.

Here are the best Debitum alternatives right now:

There are many reasons why you should consider a Debitum alternative.

First and foremost, you might not find that Debitum suits your investment needs. When it comes to P2P lending platforms, every P2P investor has different needs. It’s therefore crucial that you understand your main investment criteria and find a platform that matches.

It can also be a good idea to consider Debitum alternatives to simply diversify your investments across more than one platform and reduce your overall platform risk. This can also be done with different types of platforms like the ones you can see above.

Conclusion of our Debitum review

Debitum is currently the best option for investing in SME loans in Europe. The platform is regulated and focused on bringing a very secure investment experience to its users, which is very positive.

The platform is very user-friendly and overall nice to use.

Compared to other, maybe more speculative, business-oriented platforms such as Crowdestor and Flender, we also believe that Debitum is very well-balanced in regard to risk and reward.

All in all, we have been delighted with what Debitum has to offer, and we certainly found it to be a solid P2P platform. But you will have to keep in mind that while the platform is excellent for business loans, you can’t invest in other types of loans on the platform. Consider using multiple platforms for a broader diversification of your P2P investment portfolio.

Would you like to invest via the platform after reading our Debitum review? Then press the button below to sign up and get started: