Maclear review 2023

Read our Maclear review to decide if you should use the P2P platform.

Maclear

Pros

Cons

Maclear review summary:

Maclear is one of the most promising P2P lending platforms of the year. The platform is regulated and offers high returns of up to 15%, no cash drag, and a Provision Fund for investment protection. It has excellent customer service and positive Trustpilot reviews and does not withhold taxes, unlike many other platforms. However, it offers limited investment opportunities and lacks transparency about the Provision Fund’s size. It also currently lacks an auto-invest feature and a secondary market. Despite these limitations, its high returns, user-friendly interface, and regulatory oversight make it a promising investment option.

It’s 100% free to open an account

Introduction to our Maclear review

Maclear is a relatively new player in the P2P lending market. But, does it live up to the expectations and deliver an outstanding experience to its users?

This Maclear review was written with the intention of helping potential investors decide if Maclear is the right platform for their investment needs.

Please note that the content of this Maclear.ch review should not be taken as financial advice. Instead, it represents our viewpoints and experiences with the platform.

Below is a list of the topics discussed in this Maclear review. To learn more about a specific topic, just click on the links provided.

Learn about the following in our Maclear review:

- What is Maclear?

- Main features

- What rate of return can you expect?

- Who can invest via Maclear?

- Is Maclear safe to use?

- Best Maclear alternatives

- Conclusion of our Maclear review

What is Maclear?

Maclear is a crowdlending platform based in Zürich, Switzerland. It was launched in 2023 by the co-founders Denis Ustjev and Aleksandr Nikitin. The platform specializes in facilitating loans for small and medium-sized companies.

Investors on Maclear have the opportunity to fund these loans and earn a high return of up to 15%. The loans offered on the platform are protected by collateral and a Provision Fund, providing an added layer of security for investors.

Although Maclear is relatively small at the moment, it holds significant promise and has the potential to capture a notable market share in the coming years. With an average return of 14.60%, the platform has already attracted over 300 investors looking to capitalize on this opportunity.

On maclear.ch, you can create a user and start investing with as little as €50.

Maclear statistics:

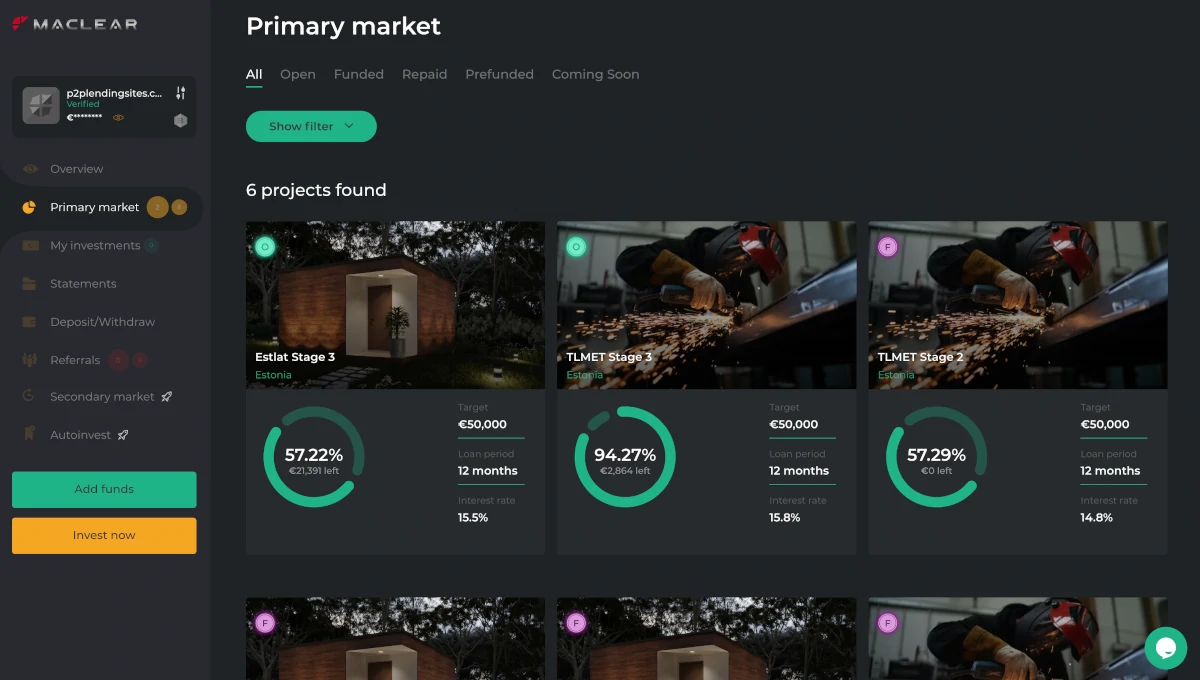

| Launched: | 2023 |

| Investors: | 300 + |

| Interest rate: | 13.5 – 15.9 % |

| Loan period: | 12 months |

| Loan type: | Business |

| Loans funded: | € 150,000 + |

| Min. investment: | € 50 |

| Max. investment: | Unlimited |

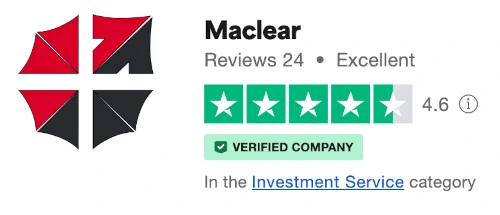

Maclear Trustpilot reviews:

Investors have rated Maclear on Trustpilot. At the time of writing, nearly all reviews are 5 stars. This has resulted in an impressive rating of 4.6 stars.

With an excellent Trustpilot score, Maclear is definitely worth considering as a P2P platform for business loans.

Main features

In this section of our Maclear review, you can read about some of the main features of the P2P business lending platform and how it compares to other platforms:

1. Maclear Provision Fund

The Provision Fund is a safety feature on Maclear, protecting investors against borrower default or late payments.

The fund is filled with 2% of successfully funded projects and commissions earned by Maclear on the secondary market.

If a borrower defaults or delays payment, the fund covers investors’ principal and interest until the borrower resumes payment or the debt is legally collected.

Despite reducing investment risks, the Provision Fund is not 100% safe, as it may not cover all investments if more projects default than there are funds available.

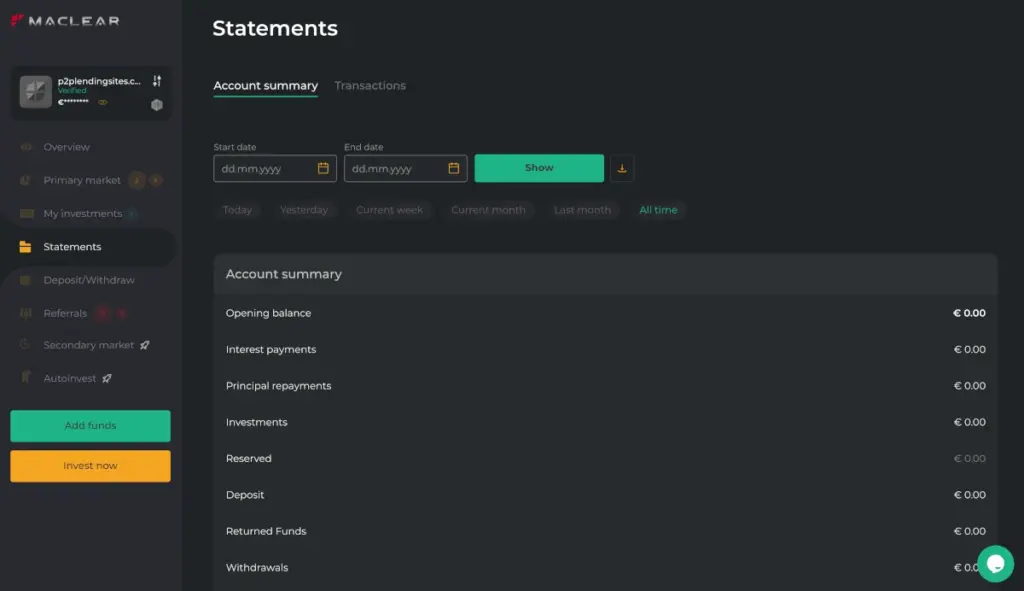

2. Tax report

Using Maclear’s platform, getting a tax report is easy. All you have to do is go to the statements section on the left side of the website. Here, you can download a statement for any time period you need.

Since Maclear is based in Switzerland, it doesn’t withhold your tax. This provides you with more cash on hand and flexibility. It also makes filing taxes easier. This is a great feature because many European P2P lending platforms have to keep taxes for their users.

3. Get a +1.5% Maclear cashback bonus

New users on Maclear can get a 1.5% cashback for the first 90 days if they sign up with a referral code or affiliate link. To get this bonus, all you need to do is click “Activate bonus” below.

This way you don’t have to rely on the refer-a-friend program to get a referral link if you don’t know anyone using the platform.

What rate of return can you expect?

The return you can get on Maclear depends on how you choose to invest your money. Currently, Maclear has an average return of 14.60%. Since this is the average return, you can reasonably expect a similar return.

The return on Maclear is quite high compared to other platforms and you should be aware that high returns often comes with similar high risks.

Who can invest via Maclear?

It is possible for both private individuals and companies to invest via the Maclear platform.

Individuals

To create a user as an individual, you must meet the following requirements:

- Be a least 18 years old

- Live in the European Economic Area (EAA)

If you match the aforementioned qualifications, getting started with Maclear is simple. Simply follow the steps below, and you should be up and running in no time:

- Sign up at https://maclear.ch/

- Verify your identity

- Add funds to your account

- Invest in loans

Companies

You can use your company, if you own one, to make investments through Maclear.

Instead of signing up as an individual, you must simply select “Company account” in the registration process.

Available countries

Maclear is available to investors in the European Economic Area (European Union, Iceland, Liechtenstein, and Norway) and Switzerland.

If you are looking for other platforms that are available outside of Europe, you should check out Bondster or Lendermarket instead.

Do you meet the requirements to sign up as an investor at Maclear? Then press the button below to get to their website. From here you can quickly create a free account and get started investing:

How safe is Maclear?

Safety is one of the most crucial factors to consider while investing money online through peer-to-peer lending websites. As a result, we have examined the platform’s security in our Maclear review.

The two areas that we examined are the safety of the investments and the company’s stability.

How safe are the investments?

The first thing we looked into when creating this Maclear review, is how secure the investments are.

Borrower default risk

Nearly all loans on Maclear comes from different companies in Estonia. There are only a few borrowers on the platform making it hard to diversify. But these investments are protected by collateral and a Provision Fund as you can learn more about in the next sections.

Collateral

To protect investments from borrower default and other risks, Maclear uses collateral and guarantees provided by the borrowers. The collateral could be in the form of assets, production equipment, machinery, or other valuable items that the borrower pledges as security for the loan.

Prior to accepting these pledges, Maclear conducts thorough risk assessments and project scoring. This process is aimed at verifying the solvency of the borrower and the value of the collateral. In the event that the borrower is unable to meet their loan obligations, Maclear, acting as a collateral agent, has the right to enforce the collection and sale of the pledged collateral.

The proceeds from this sale are then used to fulfill the financial obligations to the investors, which include both the principal amount of the loan and the interest payments. This mechanism is designed to ensure the stability of the returns for the investors.

Provision Fund

Maclear has a Provision Fund that can be used to cover the interest and principal amount of the loan, in case the enforced realization of the collaterals doesn’t cover the whole amount. This reduces the investment risk for the investors and ensures that their returns are guaranteed even if the borrower defaults.

But as previously mentioned in this Maclear review, it’s important to note that the Provision Fund is not entirely risk-free. While Maclear makes every effort to keep the fund well-stocked through their own earnings and commissions, there is a possibility that the fund might be insufficient if too many projects default at the same time. If the fund is exhausted, the investments would no longer be covered, exposing the investors to potential losses. Therefore, while the provision fund offers a level of protection, it does not completely eliminate the risk associated with the investments.

How solid is the company?

Assessing the profitability of Maclear is difficult due to insufficient historical data for new P2P lending platforms.

Accurate profitability analysis requires a significant operational track record. Maclear’s profitability hinges on its initial costs, including technology, infrastructure, marketing, and regulatory compliance.

These may exceed initial revenues, hindering profitability determination until a stable revenue stream is established.

Best Maclear alternatives

Are you unsure if Maclear is the right platform for you after reading this Maclear review?

With hundreds of P2P platforms available, it can be difficult to determine whether you have found the best platform or if you should explore other Maclear alternatives.

The main categories for P2P platforms include consumer loans, real estate, and business loans.

Here are best Maclear alternatives to consider:

There are several reasons why you should consider a Maclear alternative.

First and foremost, you may find that Maclear does not meet your investment needs. Every P2P investor has different requirements when it comes to lending platforms. Therefore, it is crucial that you understand your main investment criteria and find a platform that aligns with them.

Additionally, it can be a good idea to diversify your investments across multiple platforms, such as the ones mentioned above, to reduce overall platform risk.

Conclusion of our Maclear review

Maclear is a promising P2P lending platform with several advantages. It is regulated in Switzerland, which provides a level of confidence and trust for investors. The platform offers high returns of up to 15% and does not have any cash drag, allowing for efficient investment of funds. Maclear also provides a Provision Fund for investment protection, further enhancing the security of investments.

The customer service on Maclear is highly responsive and reliable, and the platform has received excellent ratings on Trustpilot, indicating positive user experiences. Additionally, Maclear does not withhold taxes, providing more liquidity and flexibility for investors.

However, there are some drawbacks to consider. Maclear has a relatively limited number of investment opportunities compared to larger platforms, and its track record is relatively short, which may raise some concerns. The platform lacks transparency regarding the size of the provision fund and currently does not offer an auto-invest feature or a secondary market for early exits, but these features are reportedly in the pipeline.

Overall, Maclear is a user-friendly platform with competitive returns and regulatory oversight. While it may have some limitations, it is still a promising option for investors looking to diversify their portfolios and earn attractive returns.

Would you like to invest via the platform after reading our Maclear review? Then press the button below to sign up and get started: