Lonvest review 2023

In this Lonvest review, you will get an extensive breakdown of the P2P lending platform’s features, pros, and cons. You can see a summary just below or read our full analysis to help you decide if the Lonvest platform is the right fit for you.

Lonvest

Pros

Cons

Lonvest review summary:

Lonvest is one of the most promising new platforms of the year. The platform is focused on short-term loans and offers investors an impressive average return of 13.54%. Compared to other platforms this return is excellent. With a buyback guarantee and a group guarantee on loans, Lonvest also seems like a quite safe option. But keep in mind that this doesn’t mean that your investments are 100% safe. Of the downsides, it is clear that Lonvest is still a new platform as many features are yet to be implemented.

It’s 100% free to open an account

Introduction to our Lonvest review

Investors who are considering using the P2P lending platform Lonvest may find themselves wondering if it is truly worthwhile. This Lonvest review aims to assist investors in making an informed decision about whether the platform is the best option for them. It is important to note that the content of this Lonvest.com review is purely our opinion and should not be considered financial advice.

The review will cover various aspects of Lonvest, including its features, fees, and user experience, to provide a comprehensive overview of the platform. To navigate through the review of Lonvest, simply click on the links provided for each topic of interest.

By the end of this Lonvest review, investors should have a better understanding of whether it is the right P2P lending platform for their investment needs.

Learn about the following in our Lonvest review:

- What is Lonvest?

- Main features

- What rate of return can you expect?

- Who can invest via Lonvest?

- How safe is Lonvest?

- Best Lonvest alternatives

- Conclusion of our Lonvest review

What is Lonvest?

Lonvest is a P2P lending platform that enables investors across Europe to invest in short-term consumer loans. The platform is headquartered in Zagreb, Croatia. It was established in 2023 by the entrepreneur Roman Katerynchyk, who also co-founded SpaceCrew Finance.

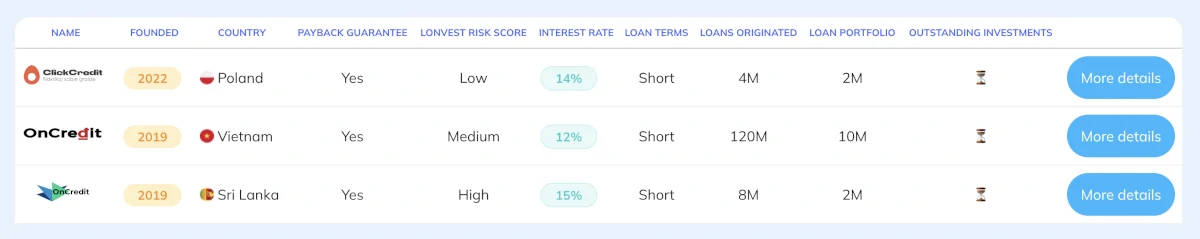

On Lonvest investors gain exclusive access to loans from SpaceCrew Finance. These loans come from ClickCredit in Poland as well as OnCredit in Vietnam and Sri Lanka.

Investors on Lonvest are currently earning an average annual return of around 13.54%. A significant advantage is that all loans are safeguarded by a buyback guarantee and an extra group guarantee. These essential aspects will be further examined later in this Lonvest review.

Since its inception in 2023, Lonvest has successfully expanded its investor base to include more than 300 individuals who have collectively funded upwards of €370,000 in P2P loans, sourced from the platform’s various loan originators.

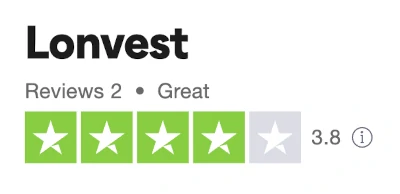

With a minimum investment of €10, you can start investing on lonvest.com.

Lonvest statistics:

| Launched: | 2023 |

| Investors: | 350 + |

| Interest rate: | 12 – 15 % |

| Loan period: | 1 – 12 months |

| Loan type: | Consumer |

| Loans funded: | € 370,000 + |

| Min. investment: | € 10 |

| Max. investment: | Unlimited |

Lonvest FAQ:

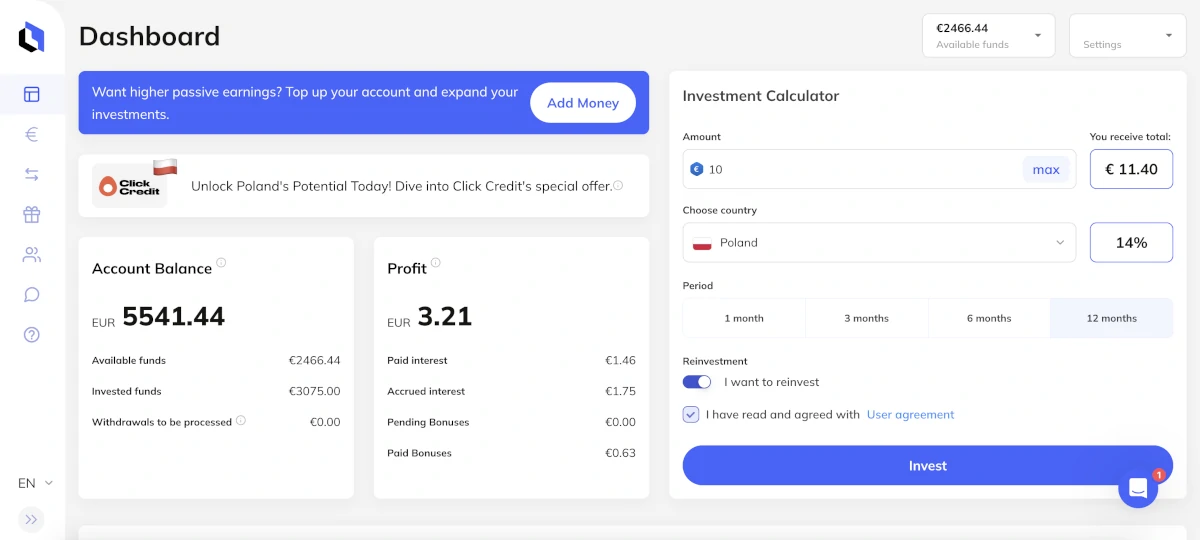

Lonvest Trustpilot reviews:

Lonvest is a great P2P lending platform on Trustpilot. Currently, the platform is rated at 3.8/5 stars on Trustpilot.

Compared to other P2P lending platforms, Lonvest does not have a lot of reviews, but based on the feedback on Trustpilot there are little red flags to be concerned about.

With only great reviews, Lonvest is worth considering for investing in P2P loans.

Main features

In the following part of our Lonvest review, you can learn about the main features of the platform, and why they are important for you as an investor.

1. Lonvest buyback guarantee

Lonvest offers investors an added layer of protection through a buyback guarantee. This means that if a borrower fails to make payments for more than 60 days, the loan originators have to repurchase the loan. The guarantee covers both the initial loan amount and any accrued interest, providing extra security for investors.

Default rates in short-term lending can be high, typically ranging from 12-22% depending on the investment strategy. Therefore, the buyback guarantee is valuable for investors.

However, it’s worth noting that the effectiveness of a buyback guarantee depends on the ability of the loan originators to fulfill it. If they are unable to do so, the guarantee becomes useless for investors.

To address this, Lonvest regularly reviews the loan originators. These evaluations assess their financial status, the quality of their loan portfolio, and their internal processes. It’s important to be aware that a potential conflict of interest arises because both loan originators and Lonvest are owned by the same lending group.

2. Lonvest group guarantee

In addition to the buyback guarantee, Lonvest provides an additional layer of protection through a group guarantee. This means that if a particular loan originator cannot fulfill their buyback obligation, other companies within the lending group are obligated to cover the debts.

This group guarantee offers further reassurance to investors, as it spreads the risk among multiple entities within the lending group. It helps to mitigate the potential impact if a specific loan originator faces financial difficulties and cannot fulfill their buyback obligation.

However, investors need to understand that the effectiveness of the group guarantee relies on the financial stability and integrity of the companies within the lending group. Regular monitoring and evaluations, as conducted by Lonvest, can help mitigate risks and ensure the reliability of the group guarantee.

Investors should carefully consider the financial health and track record of the lending group and evaluate the overall risk factors involved before making investment decisions.

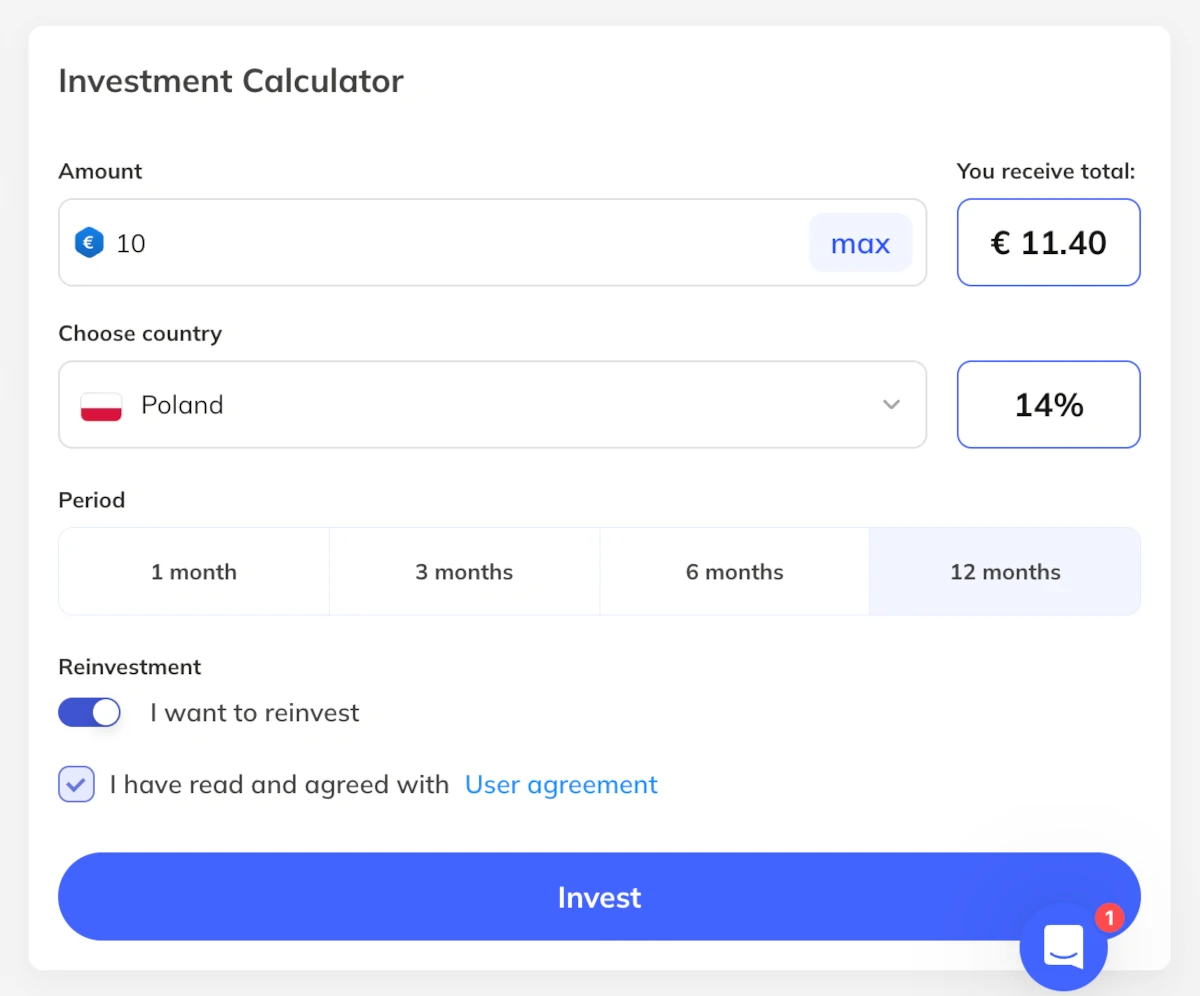

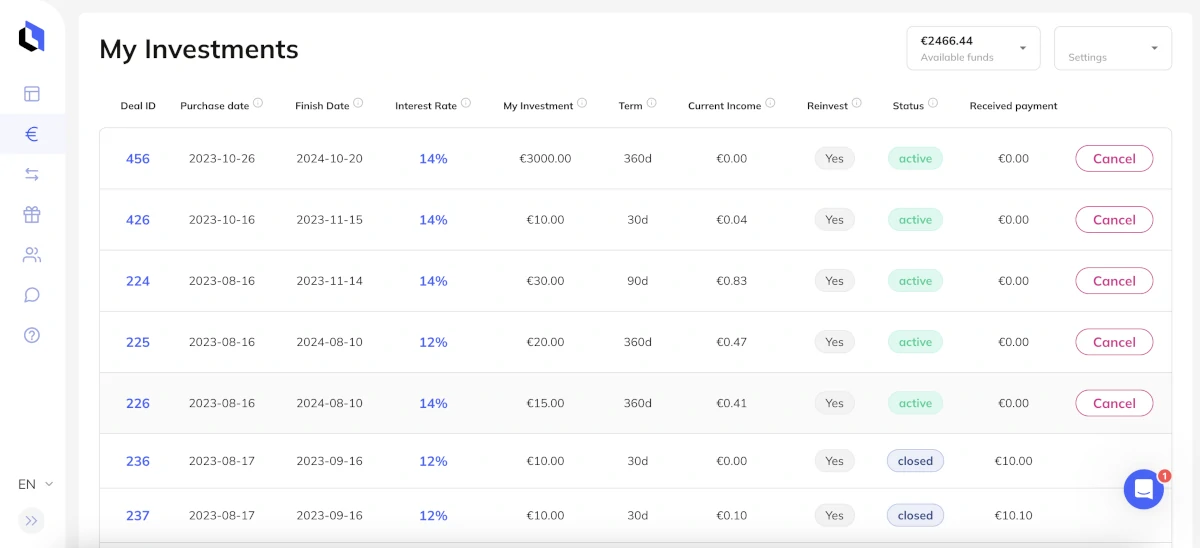

3. Lonvest auto-invest

Lonvest offers an auto-invest tool that automates your investment process and is easily accessible on the user dashboard. It is simpler to use than similar tools on other platforms and activates instantly.

However, there are limitations such as not being able to specify the amount for each loan or choose specific loan originators, and a maximum investment cap of €5,000 for loans in each country using the Lonvest auto-invest tool.

4. Get a 1% Lonvest cashback bonus

For the first 90 days, Lonvest gives new investors who are referred by its affiliates a cashback bonus of 1%.

We have included our affiliate links in this Lonvest review. This means that you can click any button that goes to Lonvest to activate the cashback bonus.

There is no need for a referral or promotion code to receive the 1% Lonvest bonus; just click the button below:

What rate of return can you expect?

The average annual return on Lonvest is 13.54%. This means that you can reasonably expect a return in that range. However, your actual return depends on how you choose to invest on the platform.

The return on Lonvest is much higher than platforms like NEO Finance, VIAINVEST, and Mintos.

Who can invest via Lonvest?

To invest via Lonvest as a private person, you must meet the following requirements:

- Be a least 18 years old

- Live in the EU

If you match the aforementioned qualifications, getting started with Lonvest is simple. Simply follow the steps below, and you should be up and running in no time:

- Sign up at https://lonvest.com/

- Add funds to your account

- Invest in loans with auto-invest

Available countries

Lonvest is available to investors in the European Economic Area (European Union, Iceland, Liechtenstein, and Norway).

If you are looking for other platforms that are available outside of Europe, you should check out Bondster or Lendermarket instead.

Do you meet the requirements to sign up as an investor at Lonvest? Then press the button below to get to their website. From here you can quickly create a free account and get started investing:

How safe is Lonvest?

Security is one of the most crucial factors to consider while investing money online through peer-to-peer lending websites. As a result, we have examined the platform’s security in our Lonvest review.

The two areas that we examined are the safety of the investments and the company’s stability.

How safe are the investments?

The first thing we looked into when creating this Lonvest review, is how secure the investments are.

Loan originator risk

All loans on Lonvest come from lending companies owned by SpaceCrew Finance.

- ClickCredit (Poland)

- OnCredit (Vietnam & Sri Lanka)

The few loan originators on the platform can make it hard to achieve proper diversification and lower your loan originator risk. If this is a concern to you, it can be a good idea to also use other platforms together with Lonvest.

Buyback guarantee

On Lonvest, the loans are covered by a buyback guarantee. This means that your investments will be bought back if the borrower doesn’t repay before the loan is 60 days overdue.

But as previously mentioned in this Lonvest review, a buyback guarantee is only as solid as the one behind it. You should never rely solely on the buyback guarantee when you invest via Lonvest.

How solid is the company?

It’s unclear from the given information if Lonvest is currently profitable or how well it is performing financially. While it’s true that setting up a P2P platform can initially be costly, a prolonged lack of profitability could be risky for investors.

However, Lonvest is part of SpaceCrew Finance, which owns several lending companies. This involvement in diverse markets could suggest financial stability and expansion, which are positive indicators of a company’s longevity and growth potential.

Unfortunately, SpaceCrew Finance is only providing revenue numbers in their financial reports on their website.

Best Lonvest alternatives

Are you unsure if Lonvest is the right platform for you after reading this Lonvest review?

With hundreds of P2P platforms available, it can be difficult to determine whether you have found the best platform or if you should explore other Lonvest alternatives.

The main categories for P2P platforms include consumer loans, real estate, and business loans.

Here are the best Lonvest alternatives right now:

There are several reasons why you should consider a Lonvest alternative.

First and foremost, you may find that Lonvest does not meet your investment needs. Every P2P investor has different requirements when it comes to lending platforms. Therefore, you must understand your main investment criteria and find a platform that aligns with them.

Additionally, it can be a good idea to diversify your investments across multiple platforms, such as the ones mentioned above, to reduce overall platform risk.

Conclusion of our Lonvest review

Lonvest is a promising new P2P lending platform that offers investors an average annual return of 13.54%. Compared to other platforms there are only a few other places investors can achieve similar high returns.

The platform is very user-friendly, but since it is still very new it lags some of the essential features like a secondary market for an early exit.

The platform is a part of a larger finance group called SpaceCrew Finance. With a group guarantee and a buyback guarantee, investing in loans via Lonvest is quite safe.

Lonvest has a great rating on Trustpilot with 3.8/5 stars. This TrustScore is quite decent compared to a lot of other P2P lending platforms.

Overall, Lonvest is a very good P2P lending platform for investing in short-term loans.

Do you want to sign up after reading this Lonvest review? Click the button below to visit the website where you can become an investor: