Loanch Review 2024: Features, Safety & Alternatives

What is Loanch?

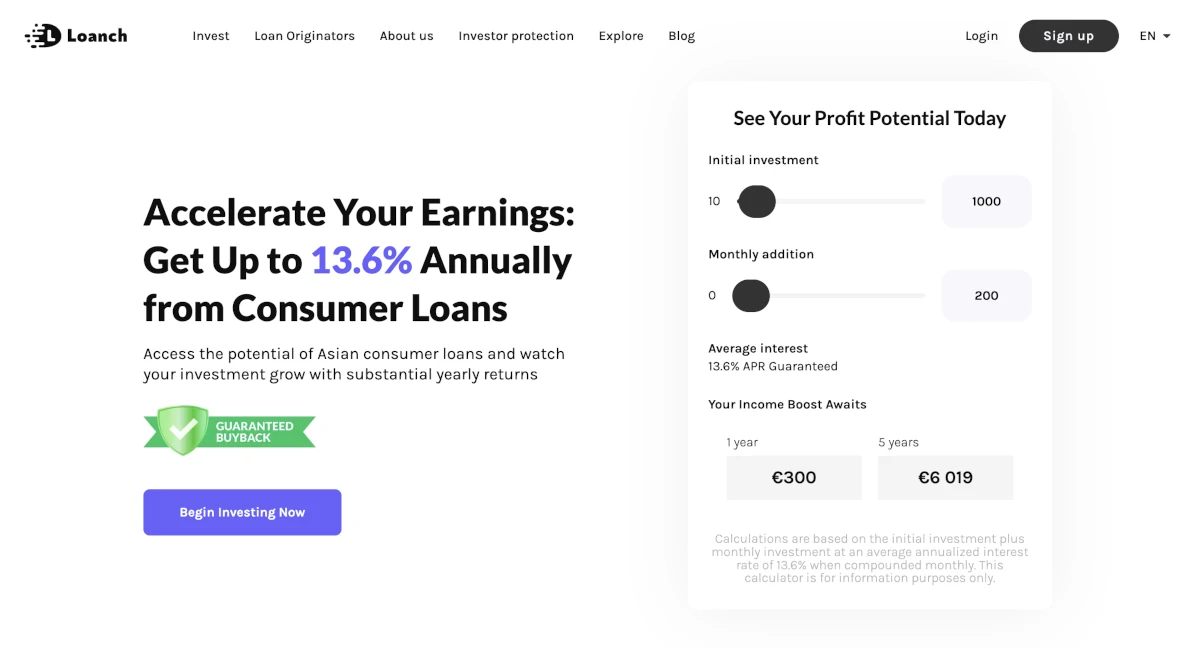

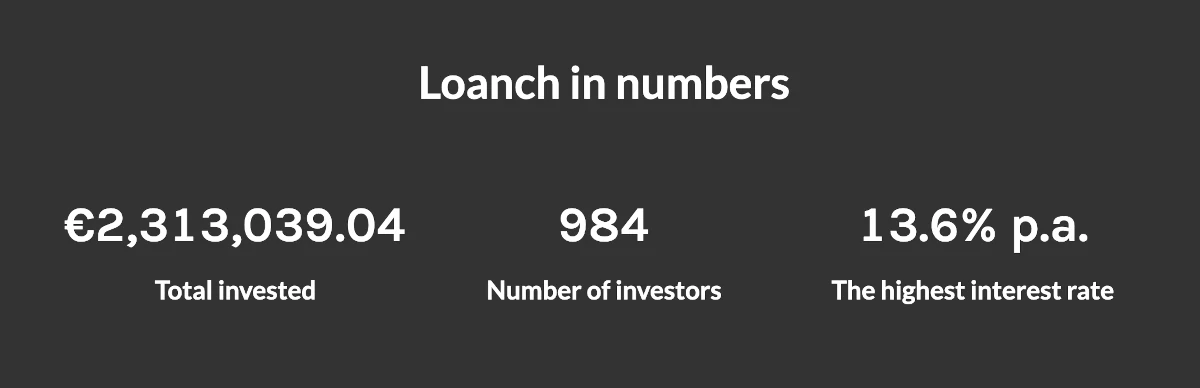

Loanch is a peer-to-peer lending platform that connects investors with licensed lenders to invest in consumer loans primarily in Southeast Asian markets. It offers an annual return rate of 13.60% for investors and features a low starting investment amount of €10.

Loanch provides a buyback obligation to reimburse investments in case of payment delays exceeding 30 days. The platform also offers an auto-invest feature to automate investment strategies based on user preferences.

How does Loanch work?

Loanch serves as a marketplace for investors to earn attractive returns by investing in consumer loans in emerging markets like Sri Lanka, Malaysia, and Indonesia.

Loanch works by allowing investors to browse through a selection of consumer loans originated by licensed lenders on the platform. Investors can then choose which loans to invest in based on their risk appetite and investment preferences.

Once an investment is made, investors start earning interest on their investment as borrowers make repayments on their loans. Loanch provides investors with detailed information about the loan originators, loan terms, and more to help them make informed investment decisions.

Loanch offers an auto-invest tool that allows investors to automate the entire investment process.

What are the expected returns on Loanch?

The annual return on Loanch is between 13.00% and 13.60%, but individual returns can vary based on the loans you choose to invest in and the performance of the underlying assets. It is important to diversify your investments on Loanch to mitigate risk and improve your chances of achieving consistent returns.

The expected returns on Loanch can vary depending on the specific loans you invest in and the overall performance of your investment portfolio.

On Loanch, you can invest in a variety of loans with different interest rates, loan terms, and risk levels. The platform provides detailed information about each loan opportunity, including the interest rate, loan originator, and risk rating.

Is it safe to invest on Loanch?

Investing with Loanch is not 100% safe. Investing always comes with risks, especially for investments with high returns of up to 13.60%. The platform has done a lot to mitigate some of the risks including having a buyback obligation on the loans.

Risks & guarantees

The primary guarantee offered by Loanch is buyback protection, which is made to protect investors from loan default risk on the platform. This buyback protection sets itself apart from most other platforms as it only requires that loans are 30 days overdue compared to the “industry standard” of 60 days.

Loanch also keeps segregated accounts for investors’ funds which means that if the company goes bust, the investor’s funds are still protected. This is more or less the standard for P2P lending platforms.

Company & team

Loanch is a fairly new company which means it doesn’t have a long track record yet. The team behind Loanch consists of the CEO Nik Sinickis and Antons Lukjanenko. Both have diverse backgrounds and expertise. While Nik brings a blend of project management, engineering, and finance skills to the table, Antons complements this with his experience in technology and development. This combination of skills suggests that the team is well-equipped to handle the technical and financial aspects of running a platform like Loanch.

Loanch also has a partnership with Finriser, a trusted SaaS platform in the industry, adds credibility to Loanch’s operations. By leveraging the technology and expertise of Finriser, Loanch can benefit from proven solutions and best practices, giving users more confidence in the platform’s reliability and security.

Loan originators

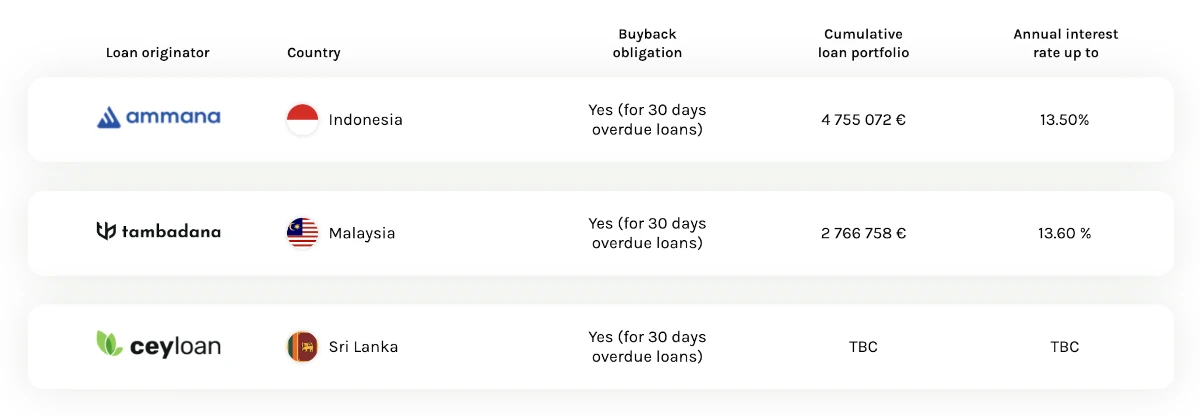

Loanch has 3 different loan originators in Indonesia, Malaysia, and Sri Lanka. The annual interest rate of the loan originators is fairly high, which means that investors should expect a fairly high risk as well.

That being said, so far the loan originators are all obligated to buy back loans that are 30 days overdue.

It’s great to see loan originators from multiple countries as it makes it possible to mitigate some geographical risk for investors using Loanch.

What are the main features of Loanch?

Here is an overview of the main features of Loanch:

1. Buyback guarantee

Loanch offers a 30-day buyback guarantee on all loans.

The buyback guarantee is provided by the loan originators. This means that the lending companies on Loanch have to buy back the loans if the loans default.

The buyback guarantee on Loanch is better than most platforms as most platforms have a 60-day buyback guarantee. On Loanch the buyback guarantee is activated after just 30 days, which is an advantage as investors don’t have to wait as long to recoup their money back from delayed loans.

2. Auto-invest

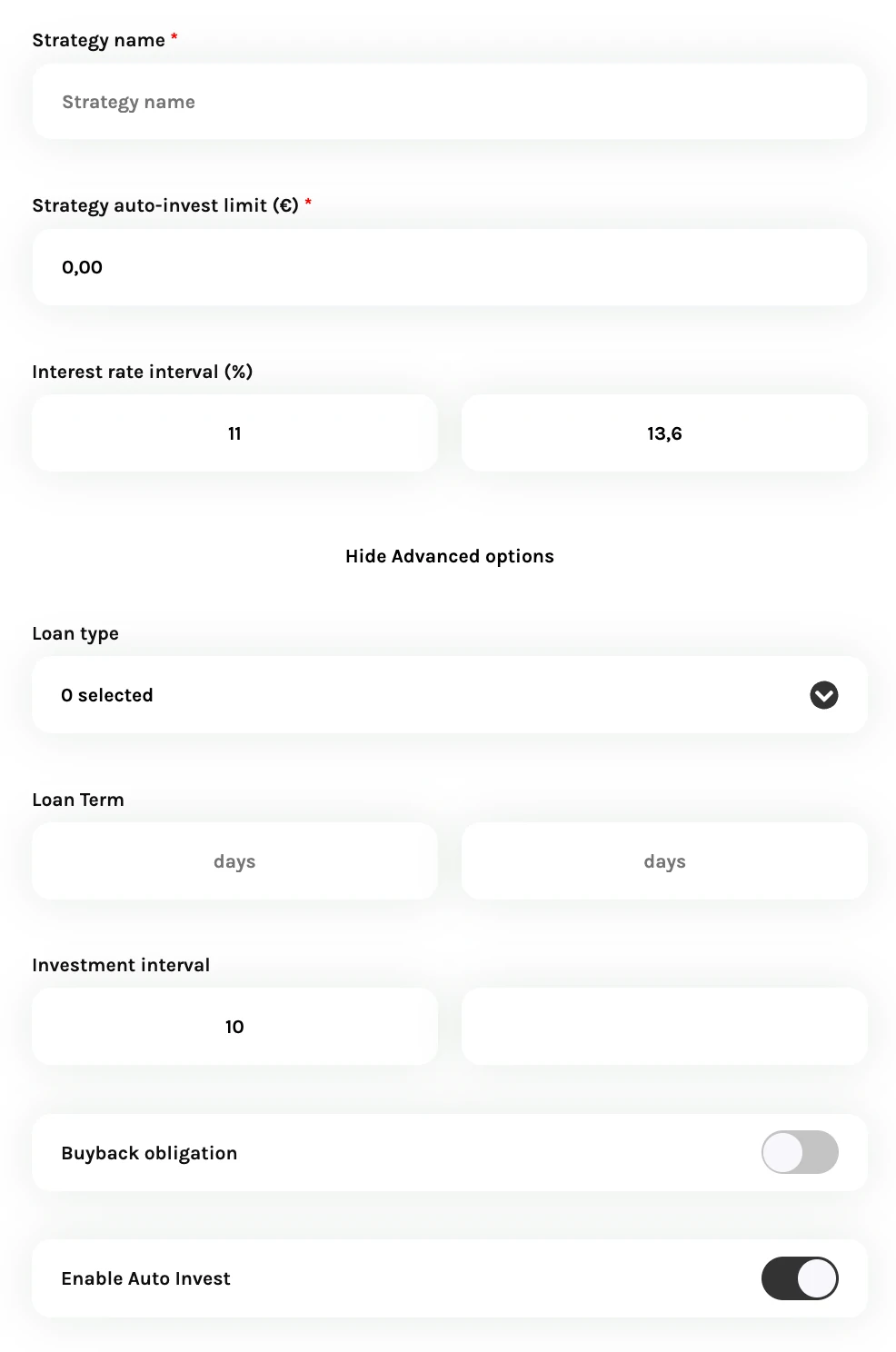

Loanch offers an auto-invest feature that is great for automating your investments on the platform.

The auto-invest feature offered by Loanch is nothing out of the ordinary, but it does the job and has all the expected features of an auto-invest tool.

3. Cashback of 1% for 90 days

Loanch offers a cashback of 1% for 90 days for new investors who sign up on the platform using a referral link (click the button below).

How to get started with Loanch?

To use Loanch, follow these steps:

- Create an account: Visit the Loanch website and sign up for a free account. You will need to provide some personal information and verify your identity using Veriff.

- Deposit funds: Once your account is set up, deposit funds into your Loanch account. You can do this via bank transfer or other accepted methods.

- Browse loans: Explore the various loan options available on the Loanch platform. You can filter loans based on criteria such as interest rate, loan term, and risk level.

- Invest in loans: Choose the loans you want to invest in and allocate funds accordingly. Loanch offers a diverse range of loan originators and types to choose from.

- Monitor your investments: Keep track of your investments through your Loanch account. You can see your returns, pending payments, and overall performance.

- Reinvest or withdraw funds: Once you start earning returns on your investments, you can choose to reinvest them in new loans or withdraw them to your bank account.

What are the fees on Loanch?

There are no fees for investors when using Loanch. All fees are placed on lending companies. This makes it easier to calculate your expected returns compared to platforms that have fees as you can just look at the average of the platform.

How does Loanch compare to other alternatives?

Compared to similar alternatives, Loanch stands out as an excellent P2P lending platform due to its great features. The primary factors for choosing Loanch over other platforms are that the platform has a shorter 30-day buyback guarantee and if you want to have your investment portfolio exposed to the loan originators Loanch works with.

Is Loanch worth giving a try?

Loanch is worth giving a try for investors interested in P2P lending.

It ultimately depends on your personal financial goals and risk tolerance. Loanch is a peer-to-peer lending platform that allows investors to fund short-term consumer loans. It has generally positive reviews from users, but like any investment, there are risks involved.

Before deciding to give Loanch a try, it is important to carefully consider the potential risks and rewards. Peer-to-peer lending can provide higher returns compared to traditional savings accounts, but it also carries the risk of borrower default and loss of investment capital.

If you are comfortable with the risks and have done your research on Loanch and peer-to-peer lending in general, it may be worth giving it a try as part of a diversified investment portfolio. However, it is always recommended to consult with a financial advisor before making any investment decisions.