Nibble Finance Legal Strategy: Is it worth it in 2023?

Nibble Finance recently launched a new investment strategy called Legal Strategy. But is it worth using for investors? We decided to investigate.

If you haven’t heard about the P2P platform before, you should read our Nibble review first.

What is the Legal Strategy?

Nibble’s Legal Strategy offers a unique debt investment product for private investors, facilitating investment in portfolios of overdue debt at significantly discounted prices.

By purchasing overdue loans at a considerable 85% markdown from banks and microfinance organizations (MFOs) at auctions, Nibble collaborates with BOOSTR, a company specializing in debt recovery, to manage and handle the acquired debt portfolio.

The loans within the Legal Strategy are categorized as B, CC, and C, signifying their high-risk nature but also their potential for high rewards.

Investors in Nibble’s Legal Strategy can expect an annual yield of up to 14.5%, with an 8% deposit-back guarantee as a safety net provided by Nibble.

This investment option requires a minimum commitment period of 6 to 12 months to accommodate the litigation and recovery processes, which tend to be more time-consuming. While this investment horizon might work for some investors, it might not be suitable for those with short-term liquidity needs.

The Legal Strategy employs a streamlined and automated approach, allowing investors to generate passive income through their investments in this unique debt product.

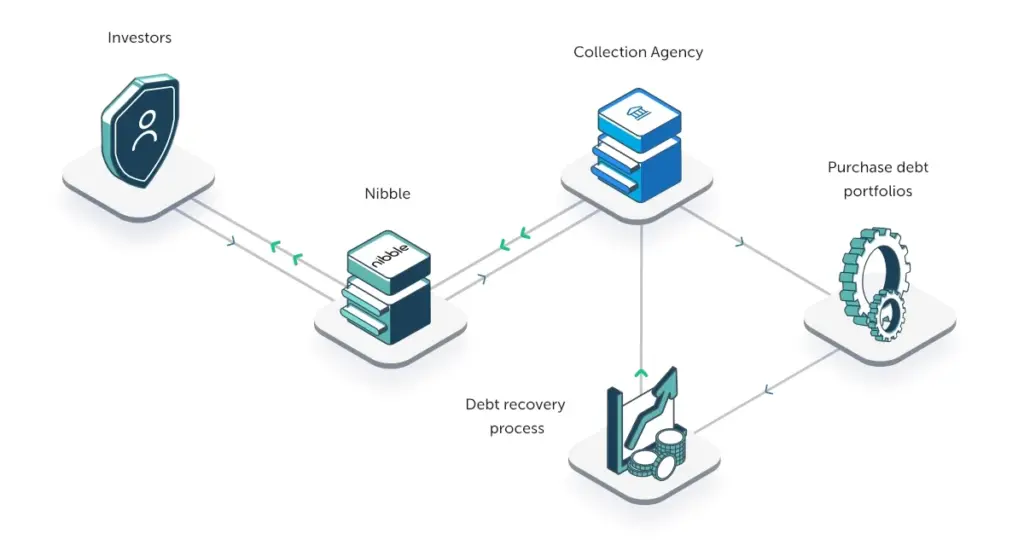

Debt recovery process

A huge part of the success of the Legal Strategy relies on the debt recovery process that is needed to make the strategy work. Here is an overview of this process:

The Nibble Legal Strategy uses a specific process to recover overdue loans from borrowers, which involves purchasing loans from banks and microfinance organizations (MFOs), contacting borrowers, and using legal proceedings to ensure debt collection.

Here’s the step-by-step breakdown of how it works:

- Loan acquisition: BOOSTR buys overdue loans from banks and MFOs at a discounted rate, usually at around an 85% discount. These loans are then compiled into loan portfolios.

- Portfolio selection: As an investor on Nibble, you get to choose a portfolio according to your preferences, and you invest in that portfolio.

- Pre-trial process: To initiate the debt recovery process, the agency contacts the borrower to discuss and arrange debt repayment. The primary goal is to reach an agreement without resorting to legal action.

- Legal proceedings: If negotiations with the borrower fail and no solution is found, legal proceedings may be initiated to ensure debt collection. This involves taking the case to court and seeking a judicial order.

- Judicial order: If the court rules in favor of debt collection, the agency receives a judicial order, which gives them the authority to collect the debt, interest, and any associated fines.

- Debt collection: With the judicial order, the agency uses bailiff services and banks to collect the debt, interest, and fines from the borrower.

- Interest accrual: As an investor, you will receive an 8% annual interest on your investment daily during the fundraising process for the chosen portfolio.

- Quarterly income calculation: Every 90 days, the platform automatically calculates the difference between the guaranteed 8% annual interest rate and the actual annual interest rate, which can be up to 14.5%.

- Quarterly income distribution: After a 90-day interval, you receive the calculated income ranging between 8% and 14.5% in your Nibble account. This process repeats itself every quarter.

By following these steps, Nibble’s Legal Strategy aims to provide investors with a means of earning competitive passive income while taking care of the debt recovery process on behalf of banks and MFOs.

Return of the Legal Strategy

The Nibble Legal Strategy is designed to offer investors an attractive return on investment, with yields reaching up to 14.5% per annum.

This is achieved by investing in portfolios that consist of consumer loans classified as B, CC, and C, which are in the process of pre-trial and judicial recovery.

Given that these loans have overdue debts and fines, the returns generated through Legal Strategy can be appealing to investors seeking alternative investment options outside traditional investments in stocks, bonds, or real estate.

Nibble’s Legal Strategy provides diversification within the investment portfolio, which is one of the primary principles of prudent investing. By venturing into the debt investment market, investors can access a different asset class with a distinct risk-reward profile compared to equity or fixed-income investments.

The return is distributed to investors every 90 days ensuring steady passive income. This regular stream of passive income can be appealing, especially in today’s low-interest-rate environment where traditional investment options might not provide similar returns.

Safety of the Legal Strategy

The Nibble Legal Strategy has several features that contribute to its safety for investors. But it is essential to note that every investment comes with some level of risk, and individual investors must carefully consider their investment goals, risk appetite, and financial situation before making any decision.

One of the key safety features of the Nibble Legal Strategy is the Deposit Back Guarantee. This guarantee assures investors that the collection agency, BOOSTR, will return the full investment amount at the end of the investment period, along with a minimum yield of 8% per annum. This minimum yield provides a level of security for investors, as it ensures a stable return on investment over time.

Additionally, the Legal Strategy invests in a diverse portfolio of loans, which helps mitigate the risk of not receiving income from a few loans, as the return from other loans covers them. This diversification reduces the overall risk associated with investing in debt portfolios.

The involvement of BOOSTR, an experienced company in debt collection and litigation management, also contributes to the safety of the Legal Strategy. BOOSTR’s expertise in buying overdue loans from banks and MFOs at discounts and automating the debt recovery process increases the likelihood of successful capital return.

While these features provide a level of safety for investors, it is essential to remember that no investment is risk-free. Investors should carefully evaluate the Nibble Legal Strategy and consult with financial professionals before making any investment decisions.

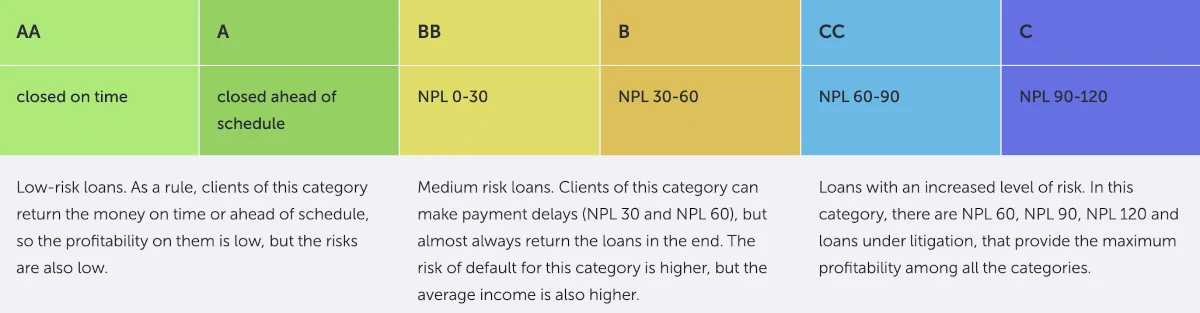

Risk classification

The Nibble Legal Strategy primarily focuses on investing in debt portfolios consisting of consumer loans with a risk classification of B, CC, and C. These loans are in the process of pre-trial and judicial recovery, meaning that the borrowers have overdue debts and fines.

The risk classification of B, CC, and C implies that the loans are not initially risk-free, as they are already overdue and face issues in repayment.

It’s essential to note that investments in such loans are typically considered riskier than investments in A or AA-rated loans since the borrowers have a higher likelihood of defaulting on their payments.

If you prefer less risky loans, you can use another strategy on Nibble.finance.

Nibble deposit-back guarantee

Nibble offers a deposit-back guarantee, meaning that the collection agency is obligated to return the full investment amount at the end of the investment period and ensure a minimum yield of 8% per annum.

With this added security measure, investors can minimize the risk of losing their invested capital while still potentially earning lucrative returns.

Is the Nibble Legal Strategy worth it?

The Legal Strategy is worth considering for investors who are interested in the peer-to-peer lending market and looking to diversify their portfolio.

The Nibble Legal Strategy presents an attractive investment opportunity for investors by offering high-yield debt investments with guaranteed returns of 8% and the potential to reach up to 14.5% per annum.

The deposit-back guarantee is an attractive feature that can provide a sense of security to investors as they are assured of a minimum return on their investment. But investors should be aware that the guarantee is only as solid as the company providing it.

However, as with any investment, it is essential to consider individual financial goals, and risk appetite, and thoroughly research the strategy before making any decisions.

Overall, this new investment product from Nibble is an excellent addition to their existing product offering.