Rendity review 2023

Read this Rendity review to learn if the platform is for you.

Introduction to our Rendity review

With Rendity, you can invest in real estate from Austria and Germany. But is it really worth using their platform? We decided to investigate.

So if you are considering investing through the platform, we recommend that you read this Rendity review first. Here we take a look at the good, the bad, and the ugly. We promise you, that you will get a better feel for the platform by reading our review.

Note: If you decide to use Rendity, you can get a €10 signup bonus by clicking this link. That is a referral link we got from the platform. If you use the link, you will also support our website.

Our Rendity review ended up being a bit long. You can, therefore, choose to use the navigation below to find exactly what you are looking for. Of course, you are also more than welcome to read the entire review. However, please note that the review only expresses our own opinion. Therefore, do not consider the content of this Rendity review as financial advice.

Learn about the following in our Rendity review:

- What is Rendity?

- Main features

- What rate of return can you expect?

- Who can invest via Rendity?

- How safe is Rendity?

- Best Rendity alternatives

- Conclusion of our Rendity review

What is Rendity?

Rendity GmbH is a FinTech company from Vienna – the capital city of Austria – that enables smaller investors to invest in real estate in both Austria and Germany.

They do so by sourcing deals from over 20 real estate developers and letting investors invest in these projects.

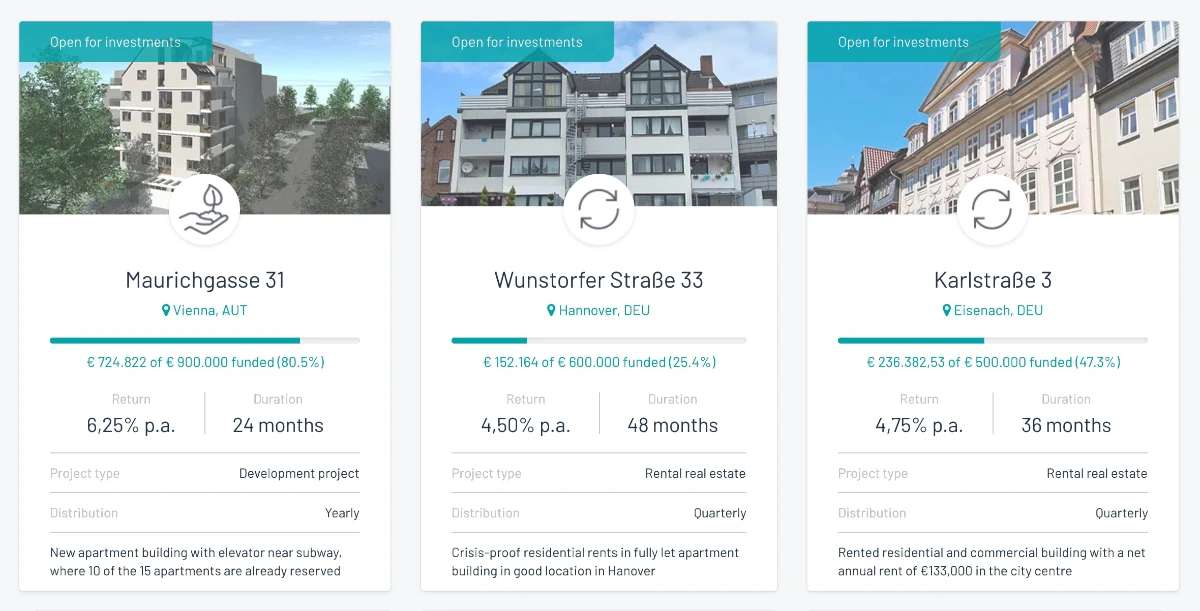

The platform was co-founded by Lukas Müller, Tobias Leodolter, and Paul Brezina. Rendity launched in October 2015. Since then, more than 30,000 investors have joined the platform to crowdinvest in 182 projects.

The investors on the platform are, on average, 41 years old. They consist of around 77% of small investors, 1% of companies, and 22% of large investors. In the past few years, there has been a big increase in large investors. Most investors are from Austria, Germany, France, the Netherlands, and Switzerland.

If you want to invest via Rendity, you can, with as little as €500, open an investment account on their platform.

Rendity statistics:

| Launched: | 2015 |

| Investors: | 30,000 + |

| Interest rate: | 4 – 8 % |

| Loan period: | 12 – 48 months |

| Loan type: | Real estate |

| Loans funded: | € 144,000,000 + |

| Min. investment: | € 500 |

| Max. investment: | Unlimited |

Rendity team:

The Rendity team as of 2023 consists of a lot of people. The team is led by:

Rendity also has an advisory board with loads of experience.

Rendity FAQ:

Rendity Trustpilot reviews:

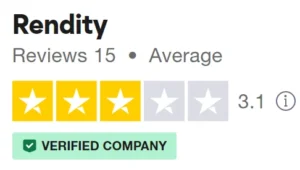

Rendity’s Trustpilot rating has improved from poor to average. Currently, the platform is rated at 3.1/5 stars on Trustpilot.

Compared to some of the best P2P lending sites, Rendity’s rating on Trustpilot is competitive.

Some of the bad Rendity reviews are due to issues with payment providers, lag of information when loans are delayed, etc.

If this is a concern to you, it might be worth checking out Robocash or Esketit instead. These platforms have very high Trustpilot ratings.

With an average rating based on 15 reviews, Rendity could be worth considering.

Main features

In the following part of our Rendity review, we will explain some of the main features of the platform, and why they are important for you as an investor.

1. Rendity robo-invest

If you are unsure about how you should invest on the platform, you can use the Rendity robo-invest feature to help you create an investment plan.

By answering a few questions about your current situation and your investment goals, you will be able to get recommendations on which products you should use on Rendity. The result will, at the time of writing, be either Rendity Income or Rendity Growth.

You can try out the feature on Rendity’s website.

2. Detailed project descriptions

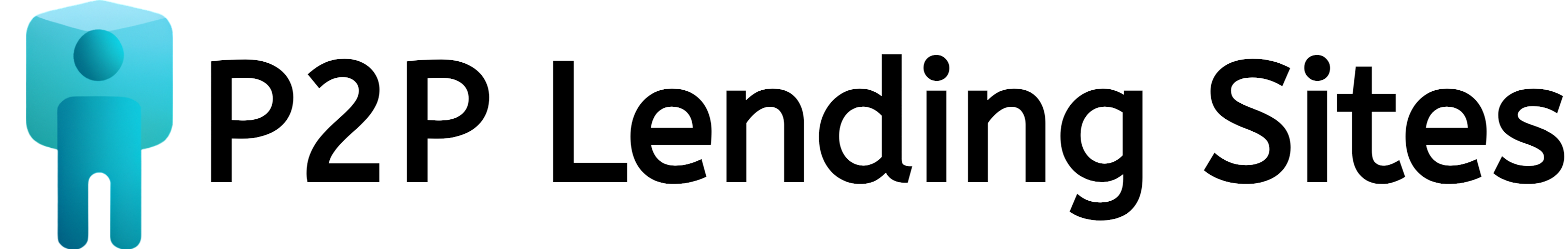

Something that makes Rendity stand out a lot from other platforms is its detailed project description. To make you get a feel for this, let’s take a look at one of the projects called Karlstraße 3.

Overview

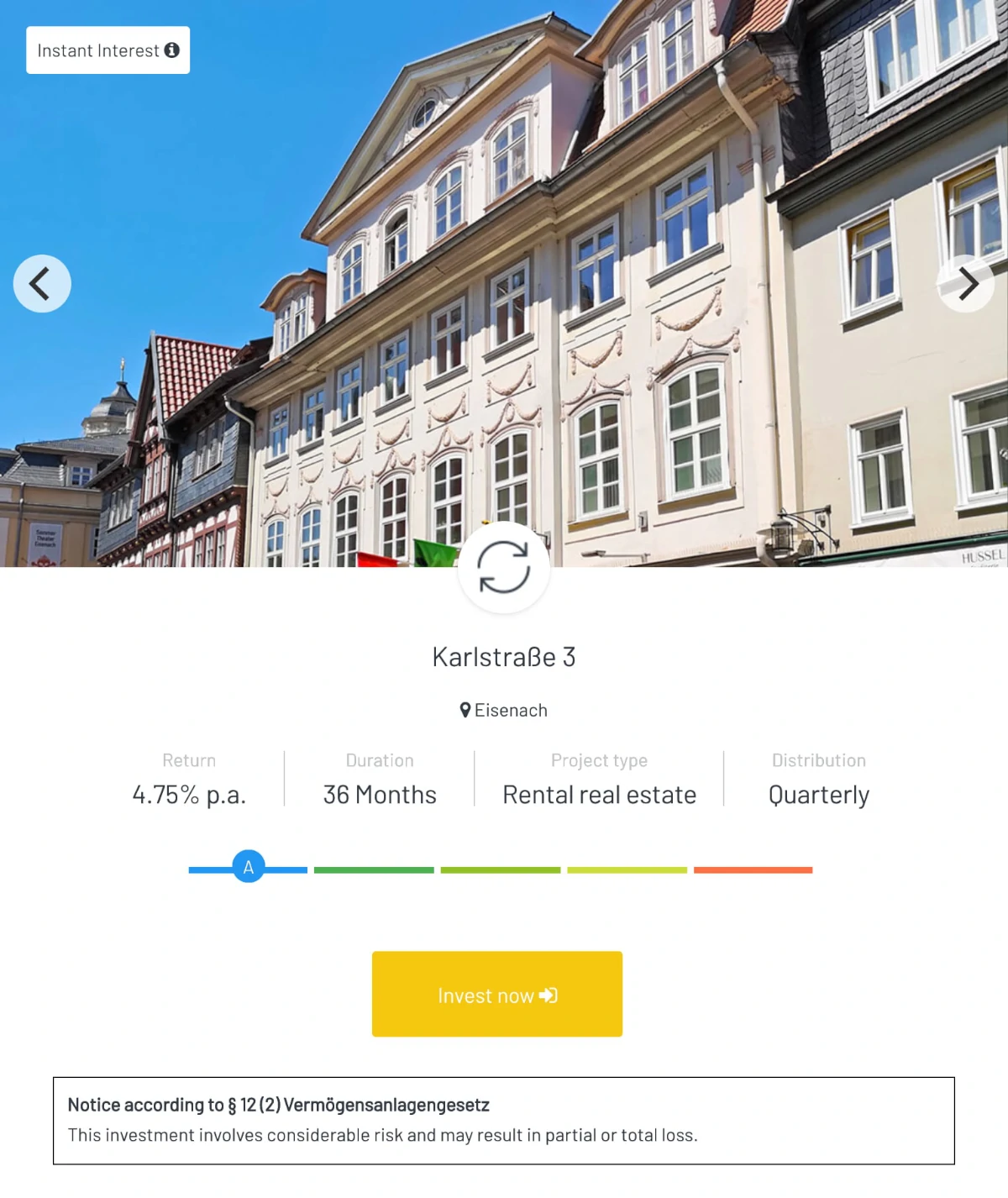

For each project on Rendity, you will be able to get a brief overview:

You will be able to see the expected return and the duration of the project. Furthermore, you will see that this particular project type is rental real estate, and the distribution is quarterly (which means that the interest is distributed to the investors on a quarterly basis). The rating for this particular project is A. You will learn more about the ratings later in this Rendity review.

Project presentation

Diving a bit deeper into the project on Karlstraße 3, you will be able to read a project presentation.

Most of the project presentations on Rendity sound a bit like sales pitches. However, you will be able to find a bit of useful information and get to know where the project is located.

Deal highlights

The deal highlights for the projects can give you a quick overview of what you get at a particular investment:

With regard to Karlstraße 3, it’s MAGAN Group that is behind the project. The current annual rental income is €133,000 and a low vacancy rate is expected. Furthermore, a bit about how you will be paid as an investor is explained as well.

Investment case

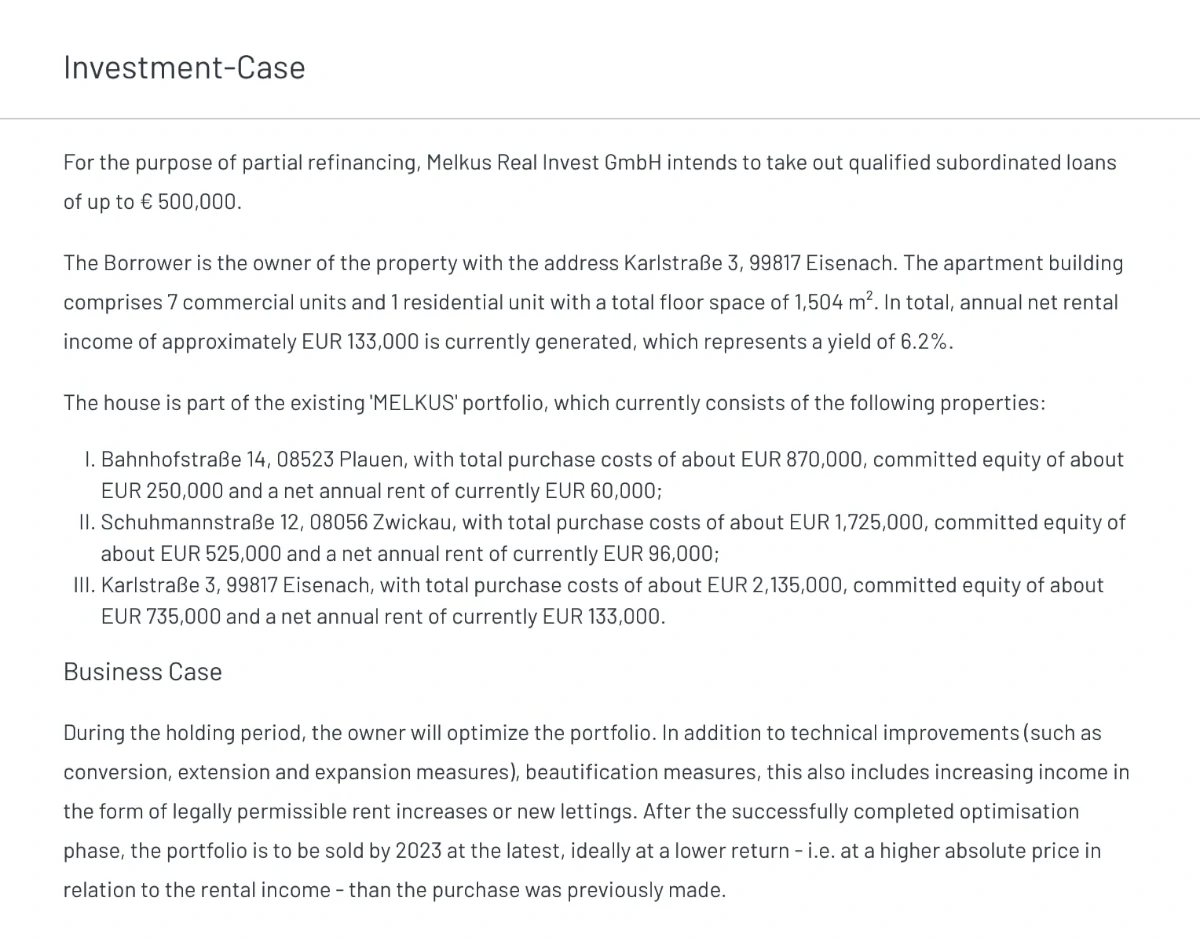

On each project, you will also be able to find an investment case:

In the investment case, it is explained what the purpose of the investment is, and how things will be going forward.

Documents

Under each project, you will also be able to find a documents section.

With regard to Karlstraße 3, both “Exposé” and “Vermögensanlagen-Informationsblatt (VIB)” were only available in Deutsch. However, the information in these documents was already mentioned in the English project description.

In the “Fact sheet”, you can find a risk notice and more in English.

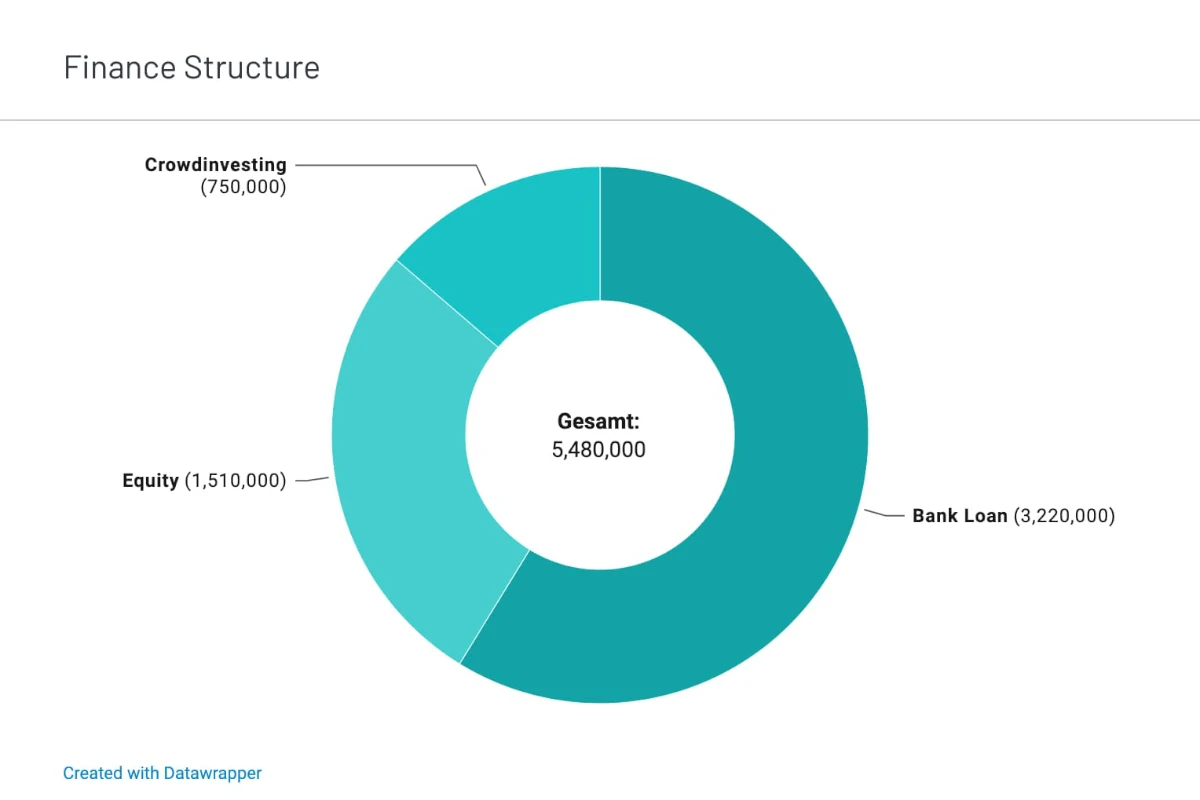

Finance structure

The financial structure of a project is also made very easy to digest, as shown in the visuals below:

As you can see, the majority of the funding in Karlstraße 3 project is actually coming from both equity and a bank loan. Only €750,000 is coming from Rendity.

If you were wondering, “Gesamt” means “in total” in Deutsch.

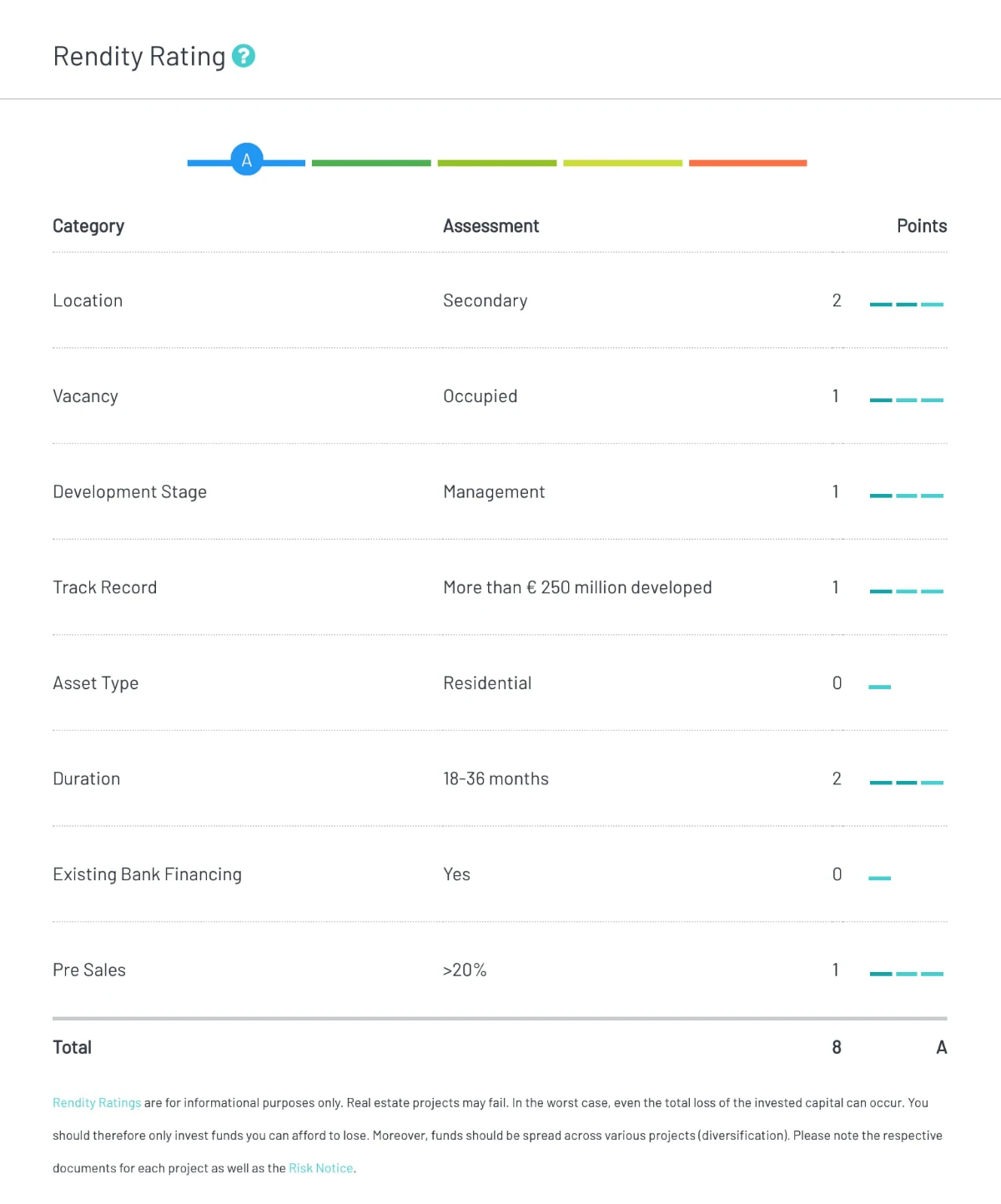

Rendity rating

You will also be able to see the Rendity rating of each project. This rating is based on a lot of factors which will be explained later in this Rendity review.

Karlstraße 3 has achieved an A-rating based on the factors shown above.

Other information

All the above information is not everything you will be able to learn in the project descriptions. You will also get to know about the tenant structure, the investment case for the particular country the investment is located in, the team behind the project, and much more.

If you want to see these things for yourself, you can check out the currently available projects on Rendity’s website.

3. Rendity rating

Previously in this Rendity review, we have already touched a bit on the ratings. However, we think it is a feature that is important for you to know more about.

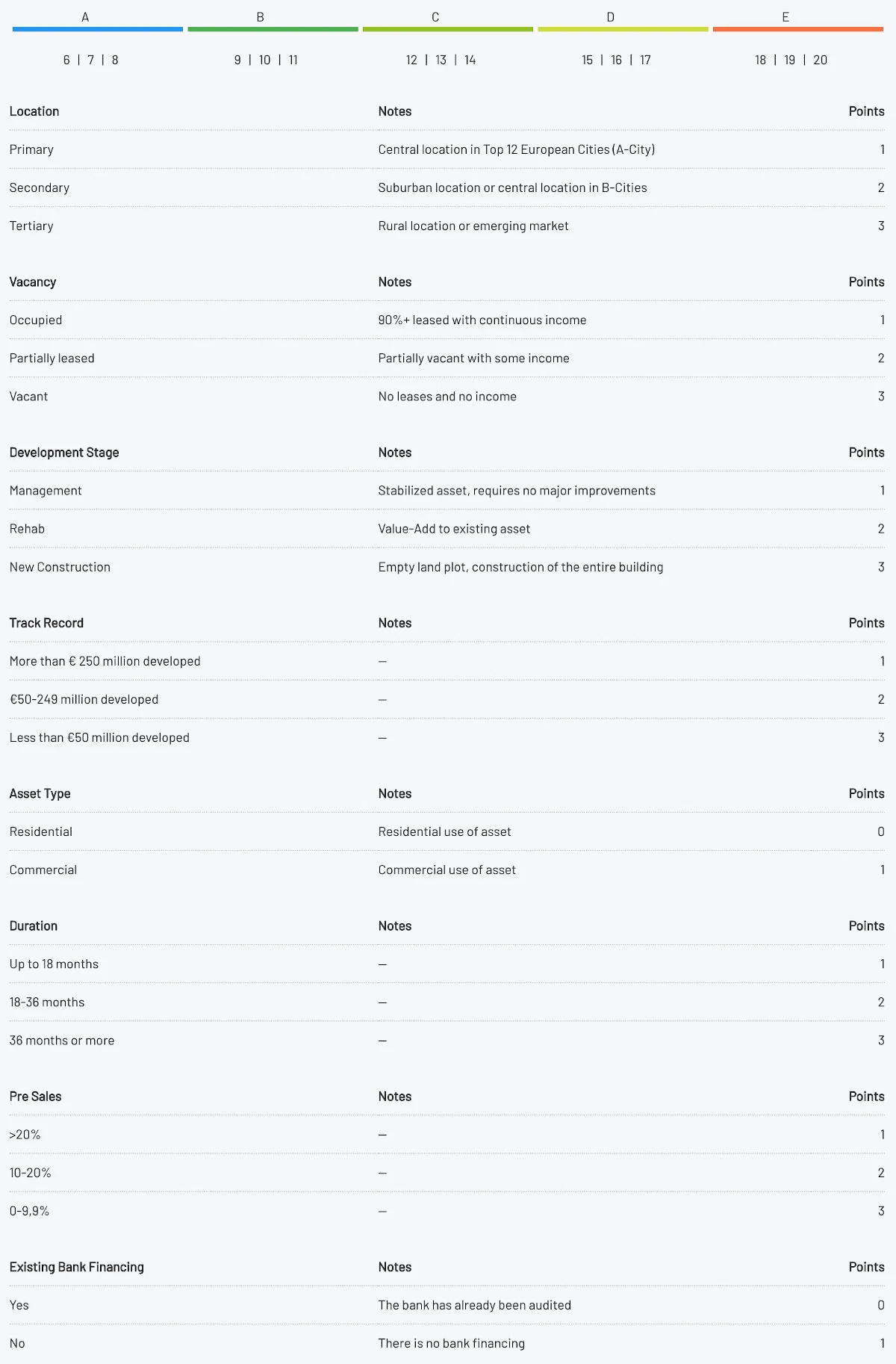

The Rendity rating ranges from A to E, where A is the lowest risk, and E is the highest risk.

The Rendity rating is determined by the following scoring system, where an A-rating will be obtained if the total number of points adds up to 6-8, a B-rating will be obtained if the total number of points adds up to 9-11, and so on and so forth.

It is important that you keep in mind that the Rendity rating is indicative, and based on the scoring system shown above. The scoring system also isn’t very similar to ratings given by rating agencies like Moody’s. So the score given to a particular project doesn’t necessarily say something about the true risk of it compared to other projects.

4. Rendity app

Rendity offers an app that makes it easy to invest in the platform on the go. The Rendity app is available for both Android and iPhone:

5. Rendity start bonus of €10

When you sign up at Rendity, you get a start bonus of €10. You won’t need a Rendity promo code to get the bonus.

However, you must be aware that the bonus has varied over time. Previously you could have gotten a 100 euro and 25 euro bonus on the platform.

What rate of return can you expect?

At the time of writing, the average annual return is 6.30% on Rendity.

The return will depend on the investments you select on the platform. But generally, the return is very low.

If your priority is high return it could be worth considering platforms like Bondster, HeavyFinance, and Max Crowdfund instead. All of these platforms have a much higher average return than Rendity.

Who can invest via Rendity?

In order to invest via Rendity you must meet the following requirements:

- Be a least 18 years old

- Have a valid bank account within the EU

If you meet the above requirements, it’s easy to get started at Rendity. Simply follow the steps below, and then you should rather quickly be able to invest:

- Create an account

- Add funds to your account

- Invest in real estate

If you want to become a Rendity investor, simply press the button below to set up an account. It’s probably the quickest way to go from reading this Rendity review to actually investing yourself:

How safe is Rendity?

One of the most important things when investing your money online through Peer-to-Peer investing platforms is that security is in order. Therefore, in this Rendity review, we have taken a look at the safety of their platform.

How safe are the investments?

The safety of the investments varies a lot depending on what type of investment you pick. Some investments are secured with different sorts of collateral, which means that if the project goes south, you will probably still get some of your invested principal back.

Investment risks

As you are dealing with real estate when you invest in Rendity, you do also take on real estate related risks. So in the event of, for example, a real estate crash, your investments could potentially lose their value.

Investor protection

Rendity is an authorized financial advisor and has to comply with strict obligations according to the Small Investor Protection Act or rather the Alternative Financing Act (“AltFG”).

Best Rendity alternatives

Are you unsure if Rendity is the right platform for you, after reading this Rendity review?

There are hundreds of P2P platforms out there, which can make it hard to determine if you have found the best platform or if you should look for other Rendity alternatives.

The main categories for P2P platforms are consumer loans, real estate, and business loans.

Here are the best Rendity alternatives right now:

There are many reasons why you should consider a Rendity alternative.

First and foremost, you might not find that Rendity suits your investment needs. When it comes to P2P lending platforms, every P2P investor has different needs. It’s therefore crucial that you understand your main investment criteria and find a platform that matches.

It can also be a good idea to consider Rendity alternatives to simply diversify your investments across more than one platform and reduce your overall platform risk. This can also be done with different types of platforms like the ones you can see above.

Conclusion of our Rendity review

Rendity is definitely standing out from the crowd of real estate crowdfunding platforms in Europe. Where other platforms mostly offer projects in the Baltics, Spain, and the UK, Rendity is offering projects from Germany and Austria.

Therefore, you will only be able to find very few competitors to Rendity in these areas. However, the downside to investing in Germany and Austria is that the return is also lower than on other platforms.

With that said we really like the platform and the fact that they offer exposure to both Germany and Austria.

Would you like to sign up as an investor on the platform after reading about our Rendity review? Then press the button below to sign up and get started: