TWINO review 2023

Read this TWINO review to learn if the platform is for you.

TWINO

Pros

Cons

TWINO review summary:

After several years on the market, TWINO has proven to be a serious P2P platform. They offer competitive rates to their investors. At the same time, TWINO has also created a profitable business, which means that they have a better foundation than many unprofitable alternatives. Investing with the platform is made easy with auto-invest portfolios and safe with buyback/payment guarantees.

It’s 100% free to open an account

Introduction to our TWINO review

TWINO was among the first European P2P lending platforms. But is TWINO safe for its investors? In this TWINO review, we take a thorough look at the platform as well as some of its main features.

If you are currently considering investing through the platform, then we recommend that you read this TWINO review thoroughly. Besides giving our best assessment of the platform, you will also be able to find some tips and tricks along the way.

We cover a number of different topics in this review. So if you just want to find answers to something specific, please use the navigation below. You are, of course, also welcome to read it all. But as you read our TWINO review, please be aware that it reflects our own opinion. Therefore, you should not consider the review as investment advice. With that said, let’s take a look at TWINO.

Learn about the following in our TWINO review:

- What is TWINO?

- Main features

- What rate of return can you expect?

- Who can invest via TWINO?

- Is TWINO safe to use?

- Can I get a TWINO promo code?

- Best TWINO alternatives

- Conclusion of our TWINO review

What is TWINO?

TWINO is a Peer-to-Peer lending platform from Riga, Latvia. On the platform, you can invest in consumer loans issued by TWINO’s subsidiary companies in Latvia, Poland, Russia, Georgia, and Kazakhstan.

TWINO started its lending activities in 2009 and opened its investment platform in 2015. Since then, over 58,000 investors have decided to join the platform.

On the platform, you can primarily invest in consumer loans with a 1-3 month loan duration. However, there are also loans in the categories 4-11 months, as well as over 12 months. In 2020, the company also added a feature called TWINO Ventures, which allows investors to also invest in real estate projects.

With as little as €10 you can start investing on the platform.

TWINO statistics:

| Launched: | 2015 |

| Investors: | 58,000 + |

| Interest rate: | 8 – 14 % |

| Loan period: | 1 – 60 months |

| Loan type: | Consumer |

| Loans funded: | € 1,000,000,000 + |

| Min. investment: | € 10 |

| Max. investment: | Unlimited |

TWINO FAQ:

TWINO Trustpilot reviews:

TWINO is doing okay on Trustpilot. Currently, the platform is rated at 3.5/5 stars on Trustpilot.

Compared to some of the best P2P lending sites, TWINO’s rating on Trustpilot is a bit low.

Some of the bad TWINO reviews are due to investors sometimes being unable to get fully invested due to a lag of loans (cash drag), extended loans, etc.

If this is a concern to you, it might be worth considering PeerBerry or Debitum instead.

With an average rating based on 58 reviews, TWINO could still be worth considering.

Main features

In the following part of this TWINO P2P review, you can learn about some of the features that make it convenient to invest via the platform.

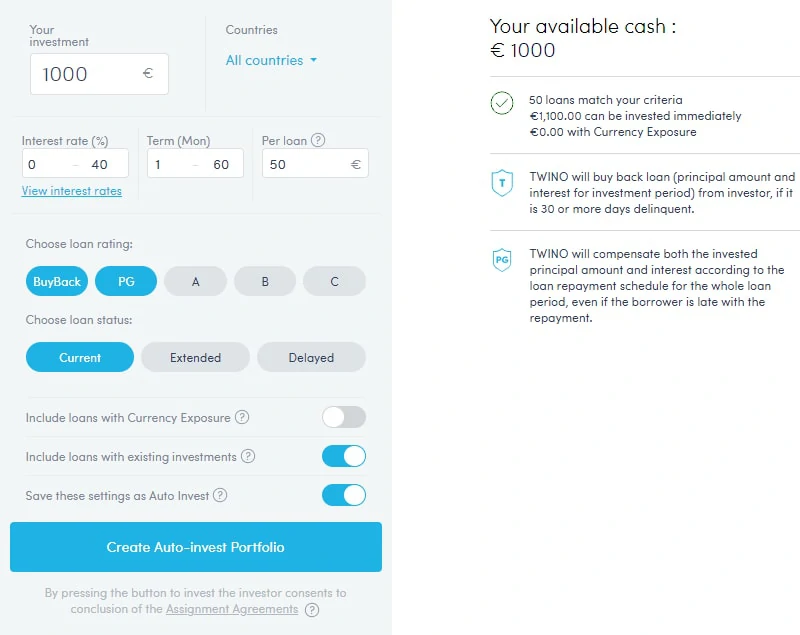

1. TWINO auto-invest

Although it is possible to invest manually on TWINO.eu, you also have the opportunity to invest with their auto-invest function. Here you can set a number of criteria for which loans you want to invest in, and then TWINO will automatically invest in loans that match your criteria. This way you can invest passively, which is also one of the reasons why we prefer to use auto-invest in our investments.

To get to the place where you can set up an auto-invest strategy, follow the steps below:

- Go to their website

- Make sure you have signed in

- Click “Invest”

- Click “Auto-Invest Portfolios”

Then you should end up with a screen like this:

When setting up your auto-invest portfolio, you must, first of all, specify how much you want to invest in everything. Next, provide information about the loans you want in your portfolio; the interest rate you are looking for, how long the loan term should be, and how much you want to invest in each loan. Furthermore, you can choose which loan rating and status you want to invest in.

If you want to use your settings as an auto-invest strategy, remember to select “Save these settings as Auto Invest”.

2. TWINO buyback and payback guarantee

TWINO offers a buyback guarantee on some of its loans. Basically, the buyback guarantee is a promise made by TWINO to its investors to repurchase loans that are not repaid by the borrower. The guarantee is valid as soon as the borrower is over 60 days late with repayment. Here TWINO has to step in and repurchase both the invested principal and accrued interest from you.

The platform also offers a payment guarantee. This is basically an upgraded buyback guarantee. With the TWINO payment guarantee, you do not have to wait 60 days to get the interest on your loans. In the event of a payment guarantee loan being defaulted, you will receive money from TWINO according to the original payment plan.

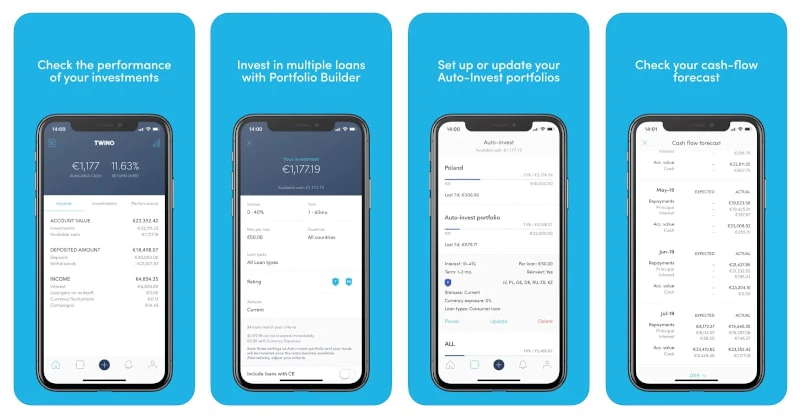

3. TWINO app

TWINO has created a free app. This makes it easy for investors to check current investments, and make new investments on the go:

The TWINO app works very well and is available for both Android and iOS.

4. TWINO secondary market

If you get an urgent need to withdraw your funds from the TWINO, you can use the secondary market to make an early exit.

On the TWINO secondary market, you can sell your investments to other investors and then withdraw your money from the platform afterward.

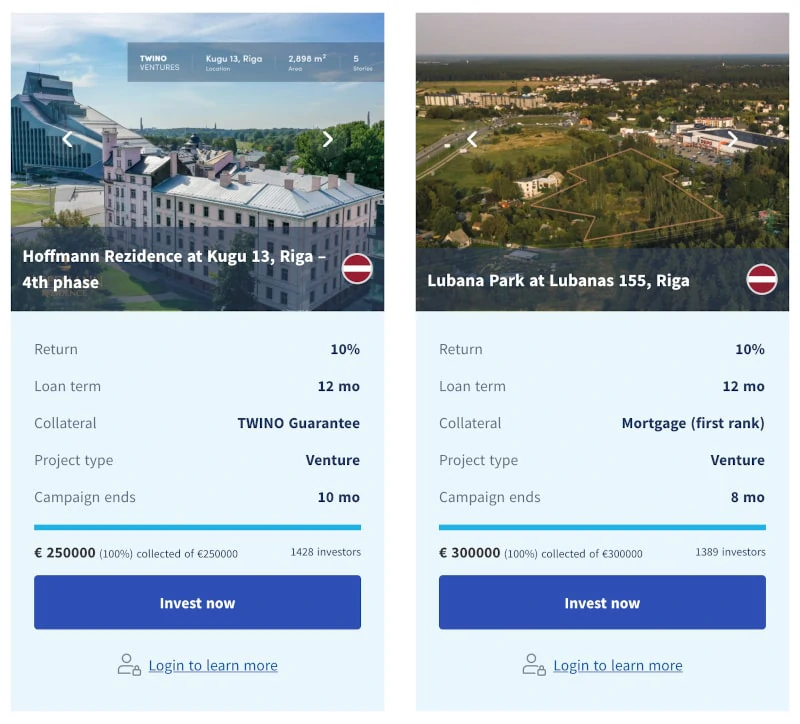

5. TWINO Ventures

In 2020, TWINO introduced a real estate focused addition to its platform that is similar to that of some of the best real estate crowdfunding platforms in Europe.

This was called TWINO Ventures and allows investors on the platform to invest in property-focused projects like the following:

As you can see in the image above, this feature has become very popular with over 1,000 investors per project. You can learn more about TWINO Ventures on the website:

What rate of return can you expect?

At TWINO, the average interest rate is 10.37%. However, what return you can earn depends in part on the maturity of the loans you invest in:

As you can see, there is a tendency for loans with lower maturities to average higher interest rates for investors. This is a good thing to keep in mind if you decide to invest via the platform.

The return on TWINO is lower than high-yielding competitors such as Bondster, Nibble Finance, and Swaper.

Investment calculator:

TWINO has put an investment calculator on its website. You can try it by clicking on the button below.

Who can invest via TWINO?

TWINO accepts investors from European Economic Area countries. Both individuals and companies can use the platform.

To invest on the platform, you must also be at least 18 years old, and be able to prove your identity.

If you meet these requirements, you can register at TWINO using the following steps:

- Create an account

- Add money to your account

- Start investing

- Earn interest

Please note that when you add money to your account, all future operations under your account will be made in the currency of your first deposit. If your first deposit is GBP, all future activities on your account will be dealt with in GBP. Otherwise, EUR will be used.

Would you like to become a TWINO investor? Then press the button below and sign up. It’s the easiest way to go from reading this TWINO review, to actually investing yourself:

Is TWINO safe to use?

When you invest in loans through TWINO it’s not without any risk. So in this part of our TWINO review, we take a look at what the risks are, and what has been done to reduce them.

Buyback guarantee

When investing in loans, there is always a risk that the borrower will not be able to repay. That’s why TWINO offers a buyback guarantee on some of their loans.

The buyback guarantee is a promise made by TWINO to its investors to repurchase loans that are not repaid by the borrower. The guarantee is valid as soon as the borrower is over 60 days late to repay. Here TWINO steps in and repurchases both the invested principal and interest from you.

Please note that not all loans are covered by the buyback guarantee. The covered loans are marked in the loan listing on their website.

Payment guarantee

On some of the loans, TWINO has a payment guarantee instead of a buyback guarantee. Contrary to the buyback guarantee, here you do not have to wait 60 days to get the interest on your loans. In the event of a payment guarantee loan being defaulted, you will receive money from TWINO according to the original payment plan.

Please note that not all loans are covered by the payment guarantee. The covered loans are marked in the loan listing on their website.

TWINO financials

A buyback and payment guarantee only is as solid as the company behind it. So let’s take a look at the financials of TWINO.

Compared to a lot of other P2P lending platforms, TWINO is very open about its financials. As an example, they post all their financial reports on the website, which makes them easy to access if the company has solid financials.

AS TWINO Investments, the company behind TWINO, had a negative result of €172,136, which makes them less profitable than a lot of other platforms.

You can find more reports and financial information in the about section on their website.

Can I get a TWINO promo code?

Even though TWINO asks “Do you have a Promo Code?” upon signing up, we are not aware of any active TWINO promo code at the moment.

But if you sign up on the platform you can get a referral bonus for referring your friends to the platform via the TWINO refer-a-friend campaign.

Best TWINO alternatives

Are you unsure if TWINO is the right platform for you, after reading this TWINO review?

There are hundreds of P2P platforms out there, which can make it hard to determine if you have found the best platform or if you should look for other TWINO alternatives.

The main categories for P2P platforms are consumer loans, real estate, and business loans.

Here are the best TWINO alternatives right now:

There are many reasons why you should consider a TWINO alternative.

First and foremost, you might not find that TWINO suits your investment needs. When it comes to P2P lending platforms, every P2P investor has different needs. It’s therefore crucial that you understand your main investment criteria and find a platform that matches.

It can also be a good idea to consider TWINO alternatives to simply diversify your investments across more than one platform and reduce your overall platform risk. This can also be done with different types of platforms like the ones you can see above.

Conclusion of our TWINO review

TWINO is an older but not unattractive player in the European crowdlending market. With a double-digit return, we also understand why people invest through their platform.

Looking at some of the disadvantages, TWINO is limited in how many loans they can have in their marketplace based on how many loans their subsidiaries issue. This has at times also proved problematic for investors on the platform who have found it difficult to find enough of the types of loans they want.

Due to these disadvantages, many investors have over time chosen to use platforms such as Mintos, EstateGuru, and VIAINVEST instead. However, the problems are not as they have been. Therefore, TWINO is again a good option as a P2P lending platform.

The fact that we are positive about TWINO is also partly due to the fact that they managed to become profitable as a company in 2018, which gives greater security to their investors.

Do you want to sign up for their platform after reading our TWINO review? Then simply click on the button below. This will take you directly to TWINO’s website, where you can sign up and start investing in their listed loans: